In today’s competitive labor market, offering affordable health insurance is one of the smartest ways to attract and retain top talent. But for small to medium-sized businesses, managing employee benefits, payroll, and compliance across multiple regions can be overwhelming. That’s where Professional Employer Organizations (PEOs) step in. PEOs simplify the process by pooling employees from various companies to access group health insurance rates usually reserved for large enterprises.

Imagine saving 25% on premiums while outsourcing HR, payroll, and compliance — all under one umbrella. For Tier One employers in the US, UK, Canada, and Australia, PEO health insurance isn’t just about cost savings; it’s about operational efficiency, compliance confidence, and access to best-in-class benefits.

In this guide, we’ll break down how PEO health insurance works, what the rates look like across top markets, and why thousands of employers are switching to this model. Whether you’re a US startup offering your first benefits package or a UK company expanding globally, understanding PEO health insurance rates could transform how you manage your workforce.

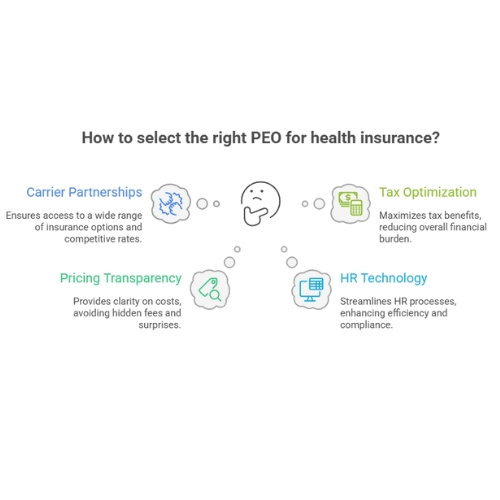

Choosing a PEO Health Insurance Rates: Evaluation Checklist for Tier One Employers

Selecting the right PEO isn’t just about comparing prices — it’s about ensuring long-term scalability, compliance, and benefit continuity. Employers in Tier One markets must evaluate factors such as carrier partnerships, pricing transparency, HR technology, and tax optimization.

| Evaluation Factor | Why It Matters | Ideal Outcome |

| Carrier Network | Access to Aetna, Blue Cross, Cigna, etc. | National and global coverage |

| Compliance Support | Avoid fines and penalties | Multi-country labor law compliance |

| Tech Integration | Payroll + benefits dashboard | Real-time reporting |

| Rate Stability | Predictable cost planning | Year-over-year savings |

| Employee Experience | Portal access & mobile apps | Higher retention and satisfaction |

Mini Case Study:

A Toronto-based SaaS firm compared three PEOs — Deel, Rippling, and ADP. Deel offered better international coverage, while ADP had deeper US carrier relationships. After evaluation, they saved 18% annually while gaining HR compliance coverage across 3 continents.

Key Tip:

Always request a rate transparency report from your shortlisted PEO. It outlines markup rates and carrier commission structures — vital for budgeting.

Explore more details here → Leading global PEOs publish plan comparisons yearly, helping businesses make data-backed decisions.

What Is PEO Health Insurance and How It Works for SMEs Across Tier One Markets

A Professional Employer Organization (PEO) partners with businesses to co-employ their workers, managing HR, payroll, taxes, and benefits administration. Under this co-employment model, employees are technically employed by the PEO for administrative purposes, allowing access to group health insurance plans that drastically lower premium rates.

For example, a small firm with 10 employees might pay $750 per employee monthly under traditional group coverage. With a PEO, the same plan could drop to around $520, saving nearly 30% annually.

How It Works:

- Your business joins a PEO as a co-employer.

- Employees are added to the PEO’s master insurance plan.

- The PEO negotiates better rates with carriers.

- You pay one consolidated monthly invoice covering payroll, taxes, and benefits.

| Region | Average Monthly PEO Health Rate (per employee) |

| United States | $480 – $620 |

| Canada | CAD 600 – 800 |

| UK | £400 – £550 |

| Australia | AUD 700 – 850 |

Result:

Businesses in Tier One markets can save 15–35% annually on premiums while maintaining top-tier coverage options.

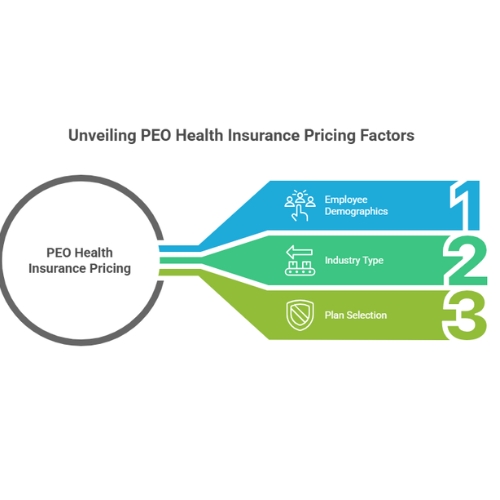

How Much Does Offering Employee Health Insurance Cost Through a PEO?

PEO health insurance pricing depends on three main variables: employee demographics, industry type, and plan selection. However, average employer costs through a PEO are consistently lower than traditional insurance.

| Plan Type | Average PEO Rate (US) | Traditional Rate (US) | Savings % |

| PPO | $590 | $720 | 18% |

| HMO | $480 | $600 | 20% |

| High-Deductible Plan | $430 | $540 | 20% |

Mini Scenario:

A Texas-based digital marketing agency with 25 employees switched to Justworks PEO. Their annual premium dropped by $32,000 while employee satisfaction rose due to expanded telemedicine coverage.

Takeaway:

Offering health insurance through a PEO isn’t just cost-effective; it’s scalable. As your workforce grows, you maintain negotiated group rates without losing carrier benefits.

Explore more details here → Compare your state’s average premium with your PEO’s quote before finalizing contracts.

Are PEO Health Plans Worth It for Startups and Enterprises in the US & Canada?

For startups, affordability and compliance are top concerns. For enterprises, scalability and data security take priority. PEO health plans serve both ends of this spectrum.

Benefits for Startups:

- Access to enterprise-grade benefits without high premiums.

- Simplified payroll, HR, and compliance.

- Improved hiring competitiveness.

Benefits for Enterprises:

- Multi-state or cross-border compliance management.

- Employee engagement tools and analytics.

- Predictable budgeting via consolidated billing.

Example:

A Vancouver-based eCommerce company joined a PEO with US operations. It unified benefits under one PEO, reducing HR admin time by 40% and insurance costs by 22%.

Key Tip:

Startups growing beyond 10 employees or expanding into the US should strongly consider PEO integration early on to lock in lower lifetime rates.

Expert Advisory Services to Help You Choose the Right PEO Platform

Many employers now rely on PEO advisory services — independent consultants who analyze pricing, compliance risk, and carrier partnerships. These experts often have insights into hidden fees, renewal clauses, and region-specific tax credits.

Benefits of Advisory Support:

- Objective comparison of PEO pricing models.

- Access to proprietary benchmarking data.

- Assistance with RFP preparation and contract reviews.

| Advisory Area | Value for Employers |

| Benefit Structuring | Avoid coverage overlap |

| Compliance Planning | Multi-country labor law support |

| Renewal Negotiation | Secure better renewal terms |

Expert Insight:

“Advisory-led PEO selection can improve ROI by up to 28% over three years,” reports HR Dive.

Explore more details here → Consider advisory platforms like PEOcompare or Deel Experts for custom consultations.

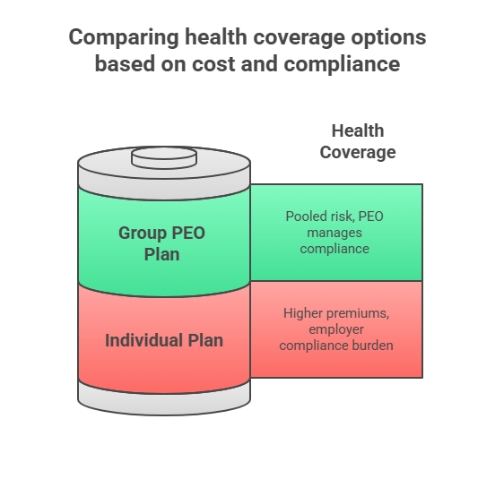

Group vs Individual Health Coverage: Cost and Compliance Benefits for Tier One Companies

Group coverage remains the most cost-efficient and compliant option for Tier One businesses. Unlike individual health plans, group PEO plans allow employers to access large-company rates through pooled risk.

| Comparison Factor | Group PEO Plan | Individual Plan |

| Average Cost | Lower (pooled risk) | Higher |

| Compliance | Managed by PEO | Employer burden |

| Renewal Rates | Stable | Volatile |

| Admin Time | Minimal | High |

Result:

Tier One companies achieve both regulatory protection and financial predictability, especially under ACA (US) and NHS guidelines (UK).

Key Takeaway:

Group health coverage through a PEO enables consistent benefits across regions while maintaining cost control.

Bundled PEO Benefits: Payroll, HR, and Insurance Savings for Businesses

Bundled services drive the PEO value proposition. Instead of managing multiple vendors for payroll, HR, and insurance, PEOs offer all-in-one solutions.

Example:

An Australian logistics company saved AUD 45,000 annually by switching to a PEO that handled payroll, HR, and health coverage under one system.

| Service | Standalone Cost | Bundled PEO Cost |

| Payroll | $20,000 | Included |

| HR Software | $10,000 | Included |

| Insurance Admin | $5,000 | Included |

Expert Insight:

Bundling saves employers 15–25% annually, primarily through administrative consolidation.

PEO-Sponsored Plans for Remote Teams Across the US, UK, and Australia

Remote workforces benefit immensely from PEO coverage, which ensures that employees in multiple states or countries receive consistent benefits.

Scenario:

A New York tech startup employs designers in Sydney and London. Through a global PEO like Deel, all workers receive uniform medical, dental, and vision coverage.

Result:

Unified coverage enhances retention and employer brand value across global markets.

Explore more details here → Check which PEOs specialize in global remote team coverage before signing.

PEOs leverage bulk processing and compliance frameworks to minimize employer tax exposure. In the US, they file under a single FEIN, optimizing unemployment tax rates.

Checklist:

- Confirm the PEO’s tax filing jurisdiction.

- Verify compliance under IRS Certified PEO (CPEO) standards.

- Review quarterly wage base limits.

Micro-CTA:

Partner with a CPEO to qualify for enhanced employer tax credit programs.

Your contribution rate — the portion of premiums your company pays — directly affects employee satisfaction and retention.

Tip:

Maintain at least 75% employer contribution for full tax deductibility in the US.

Explore more details here → Review your PEO’s contribution flexibility before renewal.

The Individual Coverage Health Reimbursement Arrangement (ICHRA) integrates well with PEO models, giving employers flexibility while maintaining compliance.

Steps:

- Employer sets monthly allowance.

- Employee selects an individual plan.

- PEO manages reimbursements.

- Tax benefits apply to both parties.

Result:

Up to 35% savings compared to fixed group premiums.

PEOs pool thousands of employees across clients, giving them leverage in rate negotiation with carriers like UnitedHealthcare and Blue Cross.

Expert Insight:

“PEO-negotiated plans often mirror Fortune 500 coverage tiers at SMB pricing,” notes SHRM.

A 50-employee Atlanta startup used the following checklist to compare PEO options:

- Compliance coverage across 4 states.

- Transparent renewal clauses.

- Carrier network access.

- Integrated HR analytics dashboard.

Result: Reduced admin workload by 38%.

Arizona’s competitive labor market drives demand for bundled HR and insurance. Local employers using PEOs save 20% annually on combined services.

Potential drawbacks include limited plan customization and dependency on PEO carrier contracts. However, most drawbacks are offset by compliance and cost advantages.

Trends include AI-driven compliance tracking, hybrid benefit structures, and global HR unification.

Key Takeaway:

Future PEO models will offer fully localized insurance via AI-based pricing.

Subscribe to get quarterly updates on carrier negotiations, state compliance changes, and premium trends.

Explore our in-depth reviews of top providers like Deel, Justworks, and TriNet to discover 2025 pricing insights.

| Region | Average Deductible | Employer Contribution % |

| US | $1,800 | 75% |

| UK | £700 | 80% |

| Canada | CAD 1,200 | 78% |

| Australia | AUD 1,000 | 77% |

Deel’s global compliance framework automates tax filing, benefits enrollment, and labor documentation in 150+ countries.

In 2025, Deel unveiled an integrated system connecting payroll, compliance, and benefits for seamless cross-border employment.

New York-based PEOs specialize in W-2 compliance, ERISA adherence, and ACA filing accuracy.

Refer back to this guide’s table of contents for detailed breakdowns of pricing, compliance, and trends.

Leading PEOs like ADP and Insperity negotiate multi-carrier agreements, ensuring stable renewal terms even in inflationary markets.

FAQ Section

1. What are PEO health insurance rates for employees?

PEO health insurance rates typically range from $480 to $620 per employee monthly in the US, with similar cost efficiencies in the UK, Canada, and Australia. Rates depend on employee age, industry type, and coverage level. Employers benefit from pooled risk, meaning large-company rates apply even to small businesses. Over time, these group-based plans can lower premium increases by 10–20% annually.

2. Best PEO for health insurance in the US and Canada

Top-rated options include Deel, Justworks, Rippling, ADP TotalSource, and Insperity. Deel stands out for global scalability, while ADP offers deep US carrier relationships. Canadian employers favor platforms like Humi and Papaya Global for compliance and tax optimization.

3. PEO health insurance rates in California

California’s average PEO health insurance rate is around $560–$640 per employee monthly, influenced by ACA mandates and regional healthcare costs. PEOs like TriNet and Justworks offer special plans that integrate with state benefits, providing predictable renewal terms.

4. What is PEO health insurance and how does it work?

PEO health insurance works through co-employment: your employees join the PEO’s larger insurance pool, gaining access to corporate-level benefits. The PEO handles plan negotiation, enrollment, and compliance while you pay a consolidated invoice — saving time, cost, and risk.

5. PEO insurance workers’ compensation and bundled savings

PEOs combine health insurance, workers’ compensation, payroll, and HR services. Bundling reduces overall admin expenses by 15–25%. Employers also benefit from unified claims management and compliance monitoring.

6. Top 10 PEO companies offering health coverage

The top 10 include: Deel, Rippling, Justworks, Insperity, TriNet, ADP, Paychex, Humi, Remote, and Papaya Global. Each offers distinct advantages across pricing, HR integration, and international benefits coverage.

7. PEO health insurance rates Reddit discussions & employer reviews

Reddit users often highlight cost savings between 15–35% compared to traditional insurance, especially for startups under 50 employees. Employers praise PEOs for transparency, consolidated billing, and compliance automation.