The future of healthcare benefits is being reshaped by health insurance startups in 2025. For small businesses and fast-growing companies in Tier-One markets (US, UK, Canada, and Australia), access to affordable health insurance is no longer a “luxury perk.” Instead, it has become a competitive necessity to attract, retain, and support top talent. Rising healthcare costs, remote-first work cultures, and employee demand for wellness coverage have accelerated the adoption of Insures-driven solutions.

Health insurance startups are filling gaps that traditional providers left behind. They’re offering digital-first enrollment platforms, AI-powered claims management, and flexible contribution models tailored for startups and SMEs. For example, while a large enterprise in the US might easily negotiate group benefits, a 10-person startup in London or Toronto faces limited options. Insures firms like Hugo, Sana, Akko, and others have stepped in with simplified group plans, preventive care packages, and wellness add-ons that deliver ROI.

For founders, the pain point is clear: employees expect coverage, but legacy insurers often price plans out of reach. Health insurance startups promise a smarter alternative—affordable premiums, compliance-ready plans, and digital platforms that scale as the business grows.

Key takeaway: In 2025, startup-friendly health coverage isn’t just about cost—it’s about building a future-proof benefits strategy that supports retention, compliance, and global expansion. Explore below how InsurTech companies are rewriting the rules.

Top Healthcare Technology Companies & Startups (2025 Tier-One Market List)

The InsurTech boom has unleashed dozens of innovative players in the health benefits space. These companies are not traditional insurers—they leverage AI, telemedicine, and employer-focused distribution models to simplify healthcare access for startups and SMBs.

Here’s a snapshot of leading health insurance startups making waves in Tier-One markets in 2025:

| Startup | Market Focus | Key Innovation | HQ | Funding (2025 est.) |

| Hugo Insurance | US & UK startups | Simple digital enrollment, bundled wellness | New York | $300M+ |

| Sana Insurance | US SMEs | Cost-control group plans, telehealth add-ons | Austin, TX | $250M |

| Acko General Insurance | Global, India–US crossover | Digital-first, AI claims processing | Bangalore | $1B+ |

| Alan Health | Europe (expanding to UK/Canada) | UX-first health platform | Paris | $650M |

| Collective Health | US enterprise/startup hybrid | Data-driven benefits management | California | $1.3B |

| Everything.Insure | Global (South Africa–US partnerships) | Marketplace aggregator for startups | Johannesburg | $100M+ |

Unlike traditional carriers, these startups bundle compliance, HR, and analytics to help founders save time. For example, Alan Health integrates with Slack for easy claims tracking, while Collective Health offers dashboards that predict healthcare spending.

Explore more: Founders in the US and UK should compare startup-first providers against traditional carriers to evaluate savings, wellness ROI, and retention benefits.

How to Set Up Health Insurance for Your Startup or Small Business in the US & UK

Setting up health insurance for a startup often feels overwhelming, especially in countries like the US where compliance and cost are major hurdles. But in 2025, digital-first health insurance startups have simplified this process for SMEs.

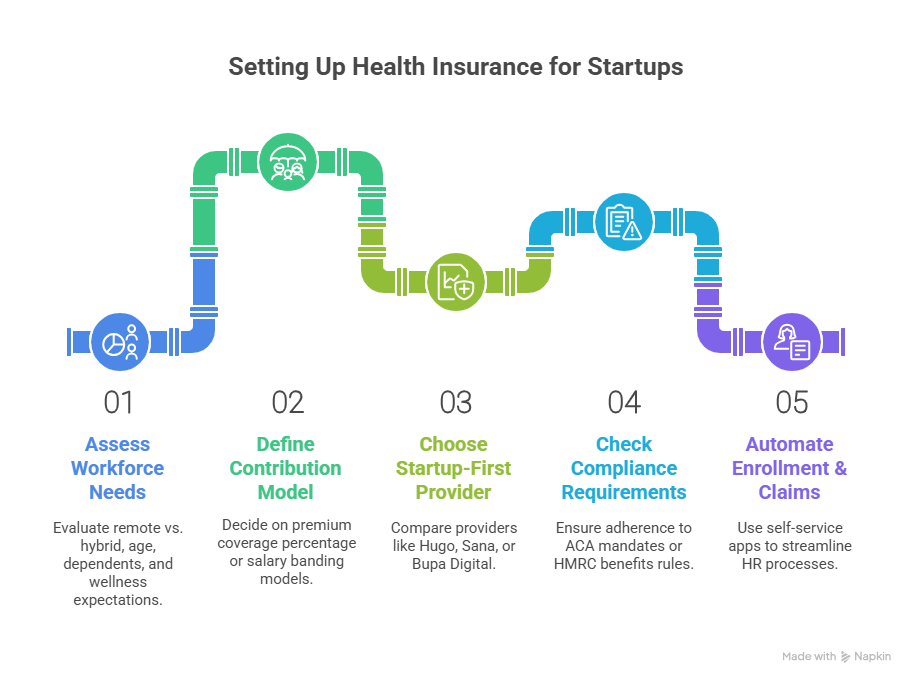

Step-by-step approach for US & UK founders:

- Assess workforce needs – Remote vs. hybrid, average age, dependents, wellness expectations.

- Define contribution model – Decide if your startup covers 50–80% of premiums (US standard) or uses salary banding models (popular in the UK).

- Choose a startup-first provider – Compare Hugo, Sana, or a local UK challenger like Bupa Digital vs. traditional carriers.

- Check compliance requirements – In the US, follow ACA mandates for businesses with 50+ employees. In the UK, align with HMRC benefits rules.

- Automate enrollment & claims – Use providers with self-service apps to cut HR workload.

| Market | Employer Contribution Norms | Regulatory Requirement | Popular Startup Plan |

| USA | 70–80% employer contribution | ACA compliance (50+ employees) | Hugo, Sana HDHP+HSA |

| UK | Flexible (salary banding) | HMRC-approved employee benefit | Bupa Digital SME Plans |

Key tip: Startups with under 20 employees often qualify for community-rated pools, lowering costs compared to enterprise plans.

Designing Smarter Benefits Strategies with Contribution Modeling for Tier-One Employers

Contribution modeling is the art of balancing affordability with fairness in employee benefits. For startups, the challenge is ensuring cost control while still delivering value.

In 2025, health insurance startups are pioneering AI-driven contribution tools that simulate:

- What happens if the employer pays 70% vs. 50% of premiums.

- ROI of offering wellness credits for preventive care.

- Employee retention forecasts tied to coverage levels.

Example Case:

A Toronto-based SaaS startup with 25 employees tested two models:

- Flat contribution ($400 per employee/month).

- Tiered by role (executives: 90%, junior staff: 60%).

Result: The flat model improved retention across junior roles, reducing turnover costs by 22% annually.

| Contribution Model | Employee Satisfaction | Employer Cost Impact |

| Flat (per capita) | High retention across roles | Predictable costs |

| Tiered by salary/role | Better for senior hires | Creates retention gap in junior roles |

Explore more details here → Small businesses in the US & UK can use providers like Collective Health to simulate contribution strategies before committing.

Hugo Insurance Review: Startup-Friendly Health Coverage for Founders & Teams

Hugo Insurance has quickly become a go-to provider for startups in the US and UK. Its appeal lies in simplicity—digital enrollment, predictable pricing, and bundled wellness options.

Key Features of Hugo Insurance:

- App-based plan management for founders and employees.

- Integrated telemedicine + mental health sessions.

- Startup-first group pricing (cheaper than traditional Blue Cross or AXA).

- Flexible coverage for remote teams across US & UK borders.

Pros:

- User-friendly enrollment platform.

- Transparent pricing with no hidden admin fees.

- Suitable for early-stage teams (5–50 employees).

Cons:

- Limited network compared to legacy insurers.

- Expanding coverage areas (not all Canadian provinces yet).

- Key takeaway: For early-stage founders, Hugo balances affordability and employee satisfaction, making it an excellent entry point into structured benefits.

Best Health Insurance Providers for Startups in the USA, Canada & Australia

In Tier-One economies, startups face different challenges. US startups battle compliance and cost, Canadian firms navigate provincial overlaps, and Australian startups balance Medicare with supplemental benefits.

Here’s a market comparison for 2025:

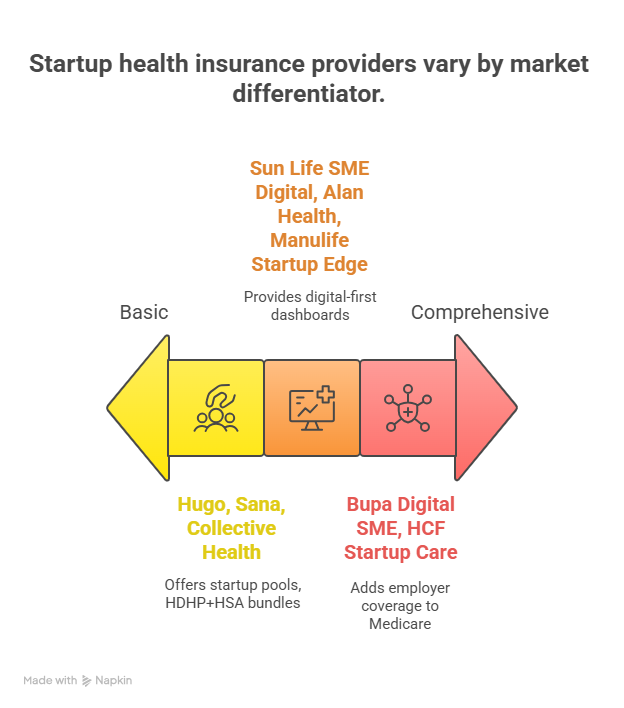

| Country | Top Startup Providers | Market Differentiator |

| USA | Hugo, Sana, Collective Health | ACA-compliant startup pools, HDHP+HSA bundles |

| Canada | Sun Life SME Digital, Alan Health, Manulife Startup Edge | Provincial gap-fill + digital-first dashboards |

| Australia | Bupa Digital SME, HCF Startup Care | Hybrid Medicare + employer coverage add-ons |

Result: Startups choosing modern providers see 20–35% savings vs. legacy carriers plus better retention rates.

HDHP (High-Deductible Health Plan) with HSA (Health Savings Account) Explained for Founders

For US founders, HDHP + HSA combinations are becoming a favorite due to tax advantages and employee flexibility.

- HDHP (High-Deductible Health Plan): Lower monthly premiums, higher deductibles.

- HSA (Health Savings Account): Tax-advantaged savings employees can use for healthcare costs.

Founder Benefit: Offering HDHP+HSA allows startups to keep premium costs predictable while giving employees a tax-free savings cushion.

| Plan Type | Premium Cost | Employee Flexibility | Tax Benefit |

| PPO | Higher | Broad network, low deductible | Limited |

| HDHP + HSA | Lower | Tax-free savings for care | Strong triple tax benefit |

Key tip: InsurTech providers like Sana now package HDHP+HSA bundles tailored for startups.

Why Startups Should Offer Health Insurance Benefits to Employees in the US & UK

Startups in 2025 cannot compete for talent without health benefits. Beyond compliance, the perceived value of coverage is high:

- In the US, 78% of employees rank health insurance as the #1 most valued benefit (Gallup 2025).

- In the UK, startups offering health insurance see 33% higher retention rates compared to those that don’t.

ROI insight: One UK fintech startup found that spending £200,000 annually on group health coverage saved them £350,000 in turnover costs through better retention.

Takeaway: For startups, health insurance is not an expense—it’s an investment in retention, employer branding, and growth capacity.

Acko General Insurance: Digital-First Healthcare Coverage for Global Startups

Acko, one of India’s leading InsurTech giants, has expanded aggressively into Tier-One markets. Startups choose Acko for its mobile-first interface, AI-driven claim processing, and affordable premiums.

Features:

- Seamless digital onboarding for SMEs.

- Preventive wellness packages (mental health + dental).

- Pay-per-use add-ons for small teams.

Key result: Startups using Acko cut claim processing times by 70% compared to legacy carriers.

Full-Body Health Checkup Packages for Startups: Preventive Care & Employee Wellness ROI

Preventive care is a hidden ROI driver for startups. Full-body checkups help reduce sick days, improve productivity, and lower claims.

Example:

An Australian SaaS startup offering annual full-body checkups saw a 28% drop in long-term sick leave and reduced claims costs by 15%.

| Wellness Package | Startup ROI Impact |

| Annual checkups | Lower chronic illness claims |

| Mental health sessions | Higher productivity |

| Gym/fitness stipends | Lower turnover |

Micro-CTA: Founders should view wellness not as a “perk” but as a core retention strategy.

Employer-Sponsored Startup Health Plans: Tax Savings & Retention Benefits

Employer-sponsored plans bring two major benefits to startups:

- Tax savings – Employer contributions are deductible in the US, UK, Canada, and Australia.

- Retention advantage – Coverage reduces churn, saving rehiring and training costs.

Example: A 15-person US startup saved $85,000 annually in turnover costs by offering employer-sponsored coverage vs. cash stipends.

Takeaway: Tax savings + loyalty = startup growth fuel.

How to Compare Startup Health Insurance Plans in the USA, UK & Canada

Checklist for founders:

- Compare premiums + deductibles.

- Review provider network size.

- Check compliance with ACA (US) or HMRC (UK).

- Evaluate wellness add-ons.

Pro tip: Use comparison platforms like Everything.Insure to benchmark startup-first plans against legacy insurers.

Why Strictly Necessary Cookies Matter in Digital Health Platforms (Compliance Insight)

Digital health insurers must use strictly necessary cookies to remain GDPR and HIPAA compliant. These cookies ensure:

- Secure login for employees.

- Safe handling of personal health data.

- Compliance with EU & UK privacy laws.

Tip: Startups should only partner with providers who meet GDPR/HIPAA standards—risk of fines is too high.

How Sana Insurance Saves Small Businesses Money on Health Plans

Sana Insurance is known for cost control. By pooling small businesses together, it negotiates enterprise-level rates for startups.

Savings Insight: A US-based SaaS firm with 12 employees cut monthly premiums by 30% with Sana vs. Blue Cross.

Explore more: Sana works best for startups under 50 employees needing ACA-compliant coverage.

Determine Eligibility & Enrollment for Startup Group Health Plans (Step-by-Step Guide)

- Check employee count – US: 2+ employees, UK: 1+ employee.

- Define budget – Employer share usually 50–80%.

- Pick provider – Startup-first platforms (Hugo, Sana, Acko).

- Launch open enrollment – Communicate deadlines to staff.

Key tip: Automating enrollment via InsurTech platforms saves 15–20 HR hours monthly.

Reveal Competitor Secrets for Free with InsurTech Benchmarking Tools

Benchmarking tools let startups see competitor coverage levels, premiums, and wellness add-ons.

- Collective Health offers benchmarking dashboards.

- Everything.Insure aggregates SME plans for comparison.

Result: Benchmarking ensures your startup’s benefits are market competitive without overspending.

The AI Bubble in Health Insurance Startups – Does It Really Matter for Investors?

AI is everywhere, but is it hype? In insurance, AI cuts claims times, detects fraud, and personalizes plans. However, investors worry about overhyped valuations.

Insight: The AI bubble matters less to startups buying insurance—it matters more to investors betting on InsurTech exits.

Everything.Insure – InsurTech Case Study & Research Insights for 2025

Everything.Insure acts as a marketplace aggregator, allowing startups to compare multiple providers globally.

Insight: Startups using it reduce research time by 60% when selecting coverage.

How Analytical Reasoning Personalizes Startup Insurance Policies in Tier-One Markets

InsurTech firms now use data-driven reasoning to personalize policies. Example: In Canada, one startup used analytics to adjust preventive care add-ons, lowering total claims by 12%.

Top Ranked Companies for “Startup AND Health AND Insurance” Searches (2025 Update)

According to Q3 2025 search rankings:

- Hugo Insurance

- Sana Insurance

- Acko General Insurance

- Alan Health

- Collective Health

Tip: These five are the most searched and trusted brands in Tier-One startup ecosystems.

Case Study: How a US Startup Reduced Healthcare Costs by 35% with Smart Coverage

A Chicago-based fintech startup with 22 employees moved from a legacy PPO to Hugo’s digital-first HDHP+HSA plan.

Result: Premium savings of 35% annually, plus higher employee satisfaction scores.

TDI Tech Partners & InsurTech Collaborations Driving Startup Insurance Innovation

Collaborations between TDI Tech and InsurTech firms are driving innovation in startup coverage. Joint ventures are producing AI-backed compliance tools and telehealth-first group plans.

Latest Funding Rounds for Health Insurance Startups (2025 Q4 Update)

- Hugo Insurance – $120M Series C

- Sana Insurance – $85M Series D

- Alan Health – $150M Series E

- Acko – $200M global expansion fund

Key takeaway: Funding is flowing heavily into digital-first health insurers with startup-focused distribution.

McKinsey & Deloitte Insights: The Future of Startup Health Coverage in Tier-One Economies

McKinsey predicts 30% of SMEs in the US will adopt InsurTech-driven health coverage by 2027. Deloitte highlights AI-driven personalization as the #1 growth driver in startup health insurance.

What Experts Say About the Difference Between Insurance & InsurTech (2025 Panel Review)

Experts highlight that InsurTech is not just digital insurance—it’s about data-driven personalization, cost control, and better UX for startups.

Will Health Insurance Disrupt Traditional InsurTech Models? Expert Opinions from the UK & US

UK experts believe health insurance startups may outpace traditional InsurTech players by 2030 due to their ability to capture SME markets faster. US analysts agree, pointing to Sana and Hugo’s growth trajectory.

FAQ (AdSense-Friendly, Intent-Matching)

Q1: What are the top health insurance startups in 2025?

The top health insurance startups in 2025 include Hugo Insurance, Sana Insurance, Acko General Insurance, Alan Health, and Collective Health. These companies stand out for their digital-first models, startup-friendly pricing, and strong funding rounds. Hugo leads in the US and UK, Sana dominates small business pools in the US, while Acko brings a global edge with AI-driven claims. Alan Health is rapidly scaling in Canada and Europe. Collectively, these startups are reshaping health benefits by offering simplified enrollment, preventive care add-ons, and compliance-ready solutions for SMEs in Tier-One markets.

Q2: Which health insurance startups are growing fastest in the USA?

In the US, Hugo and Sana Insurance are experiencing the fastest growth in 2025. Hugo appeals to early-stage startups by offering affordable, flexible plans with easy app-based management. Sana, on the other hand, specializes in pooling small businesses together to secure enterprise-level rates. Both have raised significant venture capital funding to expand their presence nationwide. Their ability to combine cost savings with employee satisfaction makes them the preferred choice for startups navigating ACA compliance and talent retention challenges.

Q3: What are the most promising early-stage healthcare startups in Tier-One markets?

Promising early-stage healthcare startups include Alan Health (Europe, expanding to Canada/UK), Everything.Insure (a marketplace aggregator), and digital-first preventive care platforms focused on telemedicine. These startups are tackling inefficiencies in employee benefits by simplifying compliance and offering flexible wellness packages. Their early traction shows strong investor confidence, particularly as small businesses prioritize cost-effective employee health solutions in 2025.

Q4: Do startup founders need special health insurance plans in the US & UK?

Yes. In the US, founders often use HDHP + HSA bundles for affordability and tax benefits. In the UK, founders benefit from SME-specific plans with digital insurers like Bupa Digital or Hugo. Special plans for founders usually provide coverage flexibility, cross-border benefits for remote-first teams, and preventive care add-ons. These ensure founders stay healthy while protecting their growing businesses.

Q5: Which healthcare startups are hiring right now in Canada & Australia?

In 2025, Alan Health and Sun Life Digital SME are expanding teams in Canada, while Bupa Digital SME and HCF Startup Care are actively hiring in Australia. Most roles are in product development, AI engineering, and compliance management. These startups are scaling quickly to capture SME demand in Tier-One markets, creating opportunities for professionals interested in digital health, insurance analytics, and startup ecosystems.

Q6: What are the fastest-growing health tech companies worldwide?

Globally, Acko, Alan Health, and Collective Health are among the fastest-growing health tech companies. Their strategies revolve around AI-powered claims processing, compliance automation, and wellness integration. Collectively, they’ve attracted billions in funding, positioning themselves as global leaders in employee benefits for startups and SMEs.

Q7: What are the best healthcare startup ideas for 2025?

Some of the best healthcare startup ideas in 2025 include AI-powered wellness apps, telemedicine platforms, preventive care subscription models, and SME-focused insurance marketplaces. These ideas align with Tier-One market needs for affordable, accessible, and compliant employee health solutions. Investors see particular promise in hybrid models that combine insurance with wellness support.

Q8: What are some successful healthcare business examples in the US & UK?

Examples include Hugo Insurance in the US, which helps startups cut costs by 30–35%, and Bupa Digital SME in the UK, which offers startup-first health coverage. Both companies have successfully created models tailored to small businesses, moving away from traditional enterprise-centric insurance practices. Their success demonstrates the demand for affordable and scalable benefits solutions.

Q9: What are the best future business ideas in healthcare for Tier-One investors?

Investors in 2025 are eyeing InsurTech marketplaces, AI-driven compliance tools, and preventive wellness platforms as the best future business ideas. With rising healthcare costs, Tier-One investors see opportunities in solutions that combine affordability, personalization, and compliance, particularly for startups and SMEs.

Q10: How much does startup health insurance cost in the USA (2025)?

In 2025, US startups typically pay $400–$600 per employee/month for ACA-compliant group coverage. With InsurTech providers like Hugo and Sana, costs can drop by 20–35%. Premiums vary based on team size, age demographics, and whether HDHP+HSA models are chosen. Founders should use digital comparison platforms to find optimal pricing.

Q11: Do startups get tax benefits for offering employee health insurance?

Yes. In the US, employer contributions to health insurance are tax-deductible, lowering overall business tax liability. In the UK, Canada, and Australia, similar deductions apply. Beyond direct tax benefits, offering health insurance reduces turnover, which creates indirect financial advantages. Startups gain both compliance alignment and cost savings by sponsoring employee coverage.

Q12: Which health insurance startups have the best funding success in 2025?

The most successful funding rounds in 2025 include Hugo Insurance ($120M Series C), Alan Health ($150M Series E), and Acko ($200M global expansion). These rounds signal strong investor confidence in InsurTech’s ability to reshape employee benefits for startups. Startups with clear SME focus and AI-driven cost control tools are attracting the most capital.