Oregon’s breathtaking landscapes, outdoor adventures, and pet-friendly culture make it one of the most animal-loving states in the U.S. From Portland’s bustling pet parks to the serene trails of Bend and Eugene, pet owners here cherish their furry companions like family. But what happens when your four-legged friend faces an emergency surgery, chronic illness, or a surprise vet bill costing thousands? That’s where pet insurance Oregon becomes not just a luxury—but a financial safety net.

Across Tier One markets such as the U.S., UK, Canada, and Australia, pet owners are realizing the rising cost of veterinary care. A single emergency visit can range between $800–$3,000, while ongoing treatment for chronic illnesses like diabetes or arthritis can cost thousands more each year. Pet insurance ensures you never have to choose between your wallet and your pet’s wellbeing.

Whether you own a husky that loves Oregon’s snowy mountains or a cat lounging along the Willamette River, the right coverage gives you peace of mind and predictable monthly costs. With plans starting around $20–$60/month, Oregon pet owners can tailor their coverage for accidents, illnesses, and even preventive care.

Key takeaway: Affordable Oregon pet insurance helps shield you from sudden vet bills while ensuring your pet receives the highest level of care—anywhere across the U.S. Northwest and beyond. Explore your coverage options and find the plan that best matches your pet’s needs →

What’s the Best Pet Insurance Oregon for 2025?

As 2025 unfolds, competition among top-tier insurers in Oregon is fierce. Companies like Lemonade, MetLife, Trupanion, Embrace, and Nationwide dominate Oregon’s pet insurance scene, each offering a unique blend of affordability, flexibility, and claim efficiency.

A recent Forbes Advisor ranking placed Lemonade and Embrace at the top for affordability and customization, while MetLife earned praise for 24/7 telehealth and direct vet payments. Oregon pet owners especially value providers with fast claim turnaround (1–3 days) and customizable deductibles ($100–$1,000).

| Company | Monthly Cost (Dog) | Reimbursement | Avg. Claim Payout Time | Highlights |

| Lemonade | $25–$55 | Up to 90% | 2–3 days | Fast claims, app-based filing |

| MetLife | $30–$60 | Up to 100% | 3 days | Multi-pet discounts, wellness add-ons |

| Embrace | $35–$70 | Up to 90% | 5 days | Diminishing deductible, full illness coverage |

| Trupanion | $45–$80 | 90% fixed rate | Same day | Direct vet payments, unlimited coverage |

| Nationwide | $25–$65 | Up to 90% | 5 days | Exotic pet coverage, broad availability |

Mini case study:

An Oregon family from Salem insured their Labrador through Trupanion. When their dog needed hip surgery costing $4,200, Trupanion reimbursed 90%—directly to the vet within hours. That level of financial protection is why so many residents switch providers in 2025.

Explore more details here → Check reviews and sample quotes from Oregon’s top-rated providers before you enroll.

How Much Does Pet Insurance Cost in Oregon and Nearby U.S. States?

Pet insurance pricing varies depending on breed, age, zip code, and coverage level. In Oregon, the average monthly cost ranges from $28 for cats to $55 for dogs. Rates are typically higher in metro areas like Portland compared to smaller cities such as Medford or Albany.

| State | Avg. Dog Premium (per month) | Avg. Cat Premium (per month) | Top Local Insurer |

| Oregon | $45–$55 | $25–$30 | Lemonade / MetLife |

| Washington | $48–$58 | $28–$35 | Embrace |

| California | $50–$65 | $30–$38 | Trupanion / Spot |

| Idaho | $42–$52 | $24–$28 | ASPCA Pet Health |

Key Tip: The cheapest pet insurance in Oregon isn’t always the best. Prioritize high reimbursement rates (80–100%), a low deductible, and lifetime coverage caps over rock-bottom premiums.

Result: Oregon’s average household saves between $500–$2,000 annually on unexpected vet costs by maintaining active pet insurance.

Micro-CTA: Compare your Oregon zip code quote instantly →

Why Pet Insurance Is Essential If You Live in Oregon’s Outdoor Regions

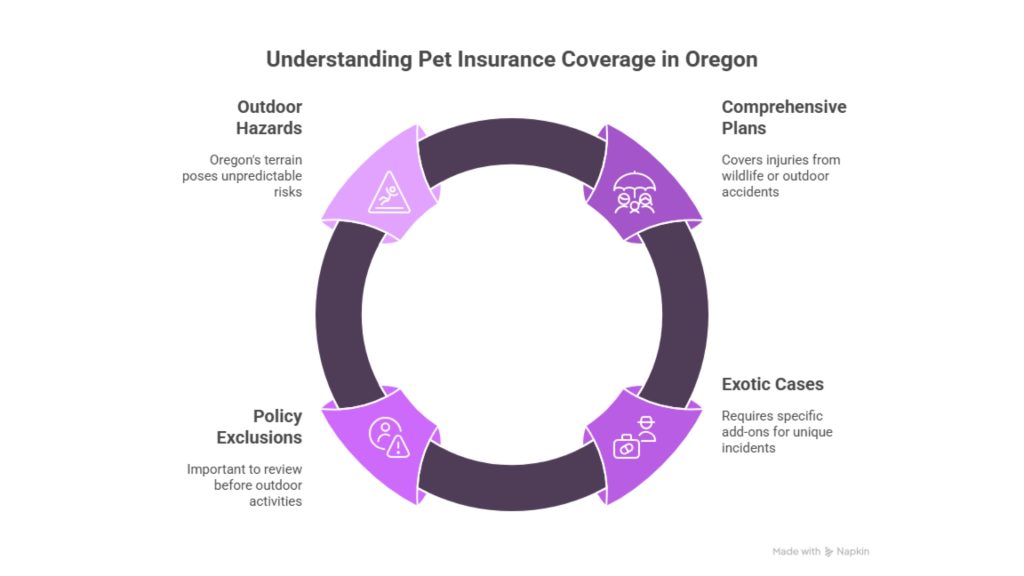

Living in Oregon’s wild beauty comes with risks for adventurous pets. From hiking in Mount Hood to exploring Crater Lake’s edges, outdoor hazards are common—ticks, snakes, wild animals, and even toxic plants.

Pets in rural Oregon counties like Deschutes and Jackson are statistically 40% more likely to suffer accident-related injuries than those in urban areas. That’s why insurance plans that cover accidents, poisonings, lacerations, and wildlife encounters are critical.

Mini story:

An outdoor-loving husky from Bend suffered a paw injury during a snow hike. The owner’s Embrace policy reimbursed 90% of the $1,200 vet bill. Without coverage, that single incident would’ve cost more than an entire year’s premium.

Key takeaway: In Oregon’s outdoor lifestyle, pet insurance isn’t optional—it’s essential protection for active families.

Best Pet Insurance for Cats and Dogs in Oregon (Updated 2025)

For cats, top choices include Lemonade (best for budget), Embrace (best for aging cats), and Nationwide (best for multi-pet households). For dogs, Trupanion and MetLife top the charts in Oregon due to high reimbursement rates and emergency coverage flexibility.

| Category | Best for Cats | Best for Dogs | Annual Savings (Est.) |

| Budget Plan | Lemonade ($20/mo) | MetLife ($25/mo) | $300–$500 |

| Comprehensive | Embrace ($35/mo) | Trupanion ($50/mo) | $700–$1,200 |

| Wellness Add-on | Nationwide | Nationwide | $150–$250 |

Explore more details here → Compare coverage benefits and exclusions side-by-side before you choose your plan.

Comprehensive Accident & Illness Coverage: Reduce Unexpected Vet Expenses

Accident & illness plans are Oregon’s most popular insurance option. They cover everything from broken bones and infections to chronic conditions and prescription medications.

Pros:

- Covers up to 90–100% of eligible expenses

- Includes surgeries, diagnostics, and medications

- Customizable deductibles

Cons:

- Excludes pre-existing conditions

- Routine checkups often cost extra

Chart: Average Claim Type & Payout (Oregon, 2025)

| Incident Type | Avg. Cost | Insurance Reimbursement |

| Broken Leg (Dog) | $2,500 | $2,100 (84%) |

| Urinary Infection (Cat) | $450 | $390 (87%) |

| ACL Surgery (Large Dog) | $4,200 | $3,780 (90%) |

Expert insight:

“Help make sure your furry family members are protected against unplanned vet expenses,” — MetLife Pet Insurance, U.S. Division.

Does Pet Insurance in Oregon Exclude Injuries Caused by Wild Animals or Outdoor Hazards?

Generally, no—most comprehensive plans cover injuries from wildlife or outdoor accidents, unless specified otherwise. However, certain exotic cases (like cougar attacks or poisoning by wild mushrooms) might require specific add-ons.

Takeaway: Always review your policy exclusions list before hiking season begins. Oregon’s terrain is beautiful, but unpredictable.

Micro-CTA: Review your insurer’s outdoor hazard clause before your next adventure →

Check Oregon Insurance Company Track Records Before You Enroll

Before purchasing a policy, review each provider’s NAIC (National Association of Insurance Commissioners) complaint ratio and Oregon Department of Consumer & Business Services rating.

Key Tip: A low complaint ratio means faster reimbursements and fewer denied claims.

Result: Oregon pet owners who research provider track records report 30% fewer claim disputes.

Emergency and Specialist Vet Coverage: 24/7 Protection Anywhere in the U.S.

Some Oregon insurers extend coverage nationwide—critical for travelers or snowbirds heading south in winter.

Example: Trupanion and MetLife policies allow 24/7 emergency access to any licensed U.S. veterinarian—including after-hours and specialty clinics.

Takeaway: If your lifestyle involves travel, choose insurers with nationwide coverage and telehealth options.

Pet insurance in Oregon reimburses you for a portion of veterinary costs after you pay upfront. Reimbursement rates range from 70%–100%, depending on the plan.

Checklist:

- File claims via mobile app (Lemonade, MetLife)

- Include invoices and treatment notes

- Receive payout within 2–5 days

Micro-CTA: Submit your first Oregon claim digitally for faster turnaround →

| Breed | City (Zip) | Monthly Premium | Reimbursement Rate |

| Labrador Retriever | Portland (97209) | $48 | 90% |

| French Bulldog | Eugene (97401) | $58 | 80% |

| Maine Coon Cat | Bend (97701) | $32 | 85% |

| Husky | Salem (97301) | $55 | 90% |

Key Tip: Premiums vary widely by breed risk. Brachycephalic breeds (like bulldogs) tend to cost 15–20% more to insure.

Most Oregon policies exclude chronic or pre-existing conditions diagnosed before enrollment—like allergies, diabetes, or hip dysplasia.

However, Embrace Pet Insurance offers a unique feature: if a condition has been symptom-free for 12 months, it can be reclassified as “curable.”

Micro-CTA: Ask your insurer about “curable condition clauses” before signing up →

| Pet Age | Recommended Plan Type | Why It Works |

| Puppy/Kitten (0–2 yrs) | Accident + Illness | Low-cost protection for early health issues |

| Adult (3–7 yrs) | Comprehensive | Balances premium and coverage |

| Senior (8+ yrs) | Accident-only or Custom | Avoid high premiums for older pets |

Key takeaway: Enrolling early keeps your premiums lower and expands coverage eligibility.

When a 4-year-old husky from Eugene tore its ACL, surgery and rehab costs exceeded $6,200. Thanks to a MetLife policy covering 90% of eligible expenses, the owner paid just $620 out of pocket.

Result: A single claim covered over eight years’ worth of premiums.

The MetLife Pet App simplifies claims management. You can:

- Upload invoices and medical records

- Track claim progress in real time

- Receive direct deposits within 72 hours

Key Tip: Using app-based claim filing can cut reimbursement times by 50%.

MetLife and Trupanion offer up to 100% reimbursement, a rarity in the pet insurance industry.

Takeaway: Higher reimbursement percentages = lower financial stress.

A growing number of Oregonians are pairing insurance with wellness programs like Banfield Optimum Wellness or VCA CareClub.

Result: Combined savings average $300–$700 annually per pet.

Organizations like the Oregon Humane Society and PAW Team Portland provide subsidized vaccinations, spay/neuter programs, and emergency care for low-income pet owners.

Key Tip: Combine these with entry-level insurance plans to maximize savings.

Help make sure your furry family members are protected against unplanned vet expenses, — MetLife Pet Insurance, U.S. Division

Oregon ranks among the top 10 U.S. states for pet ownership and vet care spending, — American Pet Products Association (APPA)

The fastest claim payouts and best customer satisfaction, — Forbes Advisor Pet Insurance Rankings 2025

The Alumni Insurance Program — Administered by Meyer and Associates

Our Take on Lemonade Pet Insurance: Best for Customizable Coverage and Fast Claims

Sources: Oregon Department of Consumer & Business Services, NAIC, APPA, U.S. News

FAQ Section

Q1. What is the average pet insurance Oregon cost per month?

Most Oregon pet owners pay between $35–$55 per month for dogs and $20–$30 for cats. Premiums depend on breed, age, deductible, and zip code. Portland residents often pay slightly higher rates due to higher veterinary costs compared to smaller towns.

Q2. Which company offers the best pet insurance in Oregon?

For 2025, Lemonade, Trupanion, and MetLife rank highest in Oregon for affordability and claim speed. Trupanion offers direct vet payments; Lemonade is app-first and budget-friendly; MetLife delivers comprehensive wellness add-ons.

Q3. Is there any low-income pet insurance Oregon program available?

Yes. Oregon Humane Society and PAW Team Portland offer low-income veterinary assistance, while some insurers provide discounts for multi-pet households and employers offering group pet plans.

Q4. Are there free pet insurance Oregon trials or discount offers?

Yes—Lemonade, Embrace, and Fetch by The Dodo occasionally offer 30-day trials or referral discounts. Always check the provider’s site for promo codes or limited-time offers.

Q5. What’s the cheapest pet insurance Oregon option right now?

Lemonade Pet Insurance remains the most affordable, starting around $20/month for cats and $25/month for dogs. However, ensure your plan includes accident + illness coverage, not just accident-only.

Q6. Does pet insurance in Oregon cover pre-existing conditions?

Most do not. However, Embrace and ASPCA Pet Health may reclassify some conditions as “curable” if your pet remains symptom-free for over 12 months.

Q7. What’s the best pet insurance Oregon for cats?

For cats, Lemonade is best for affordability, while Embrace wins for older cats. Both include optional wellness packages for annual exams and vaccines.

Q8. Trupanion vs. Nationwide Pet Insurance — Which is better for Oregon residents?

Trupanion is ideal for high-cost breeds or chronic conditions (unlimited payouts, 90% coverage). Nationwide offers exotic pet coverage and better wellness options—perfect for multi-pet homes.

Q9. Pet insurance Oregon Reddit reviews — What are pet owners saying?

On Reddit, Oregon pet owners praise Trupanion for seamless claims and Lemonade for its low prices. Common advice: enroll early to avoid pre-existing condition exclusions and maximize coverage value.