September 2025 marks National Pet Insurance Month, a celebration that shines a spotlight on the growing importance of pet health coverage across Tier One countries — the US, UK, Canada, and Australia. This global awareness movement reminds pet parents that veterinary bills can often reach thousands of dollars, but with the right pet insurance plan, you can protect both your furry friend and your finances.

Pet insurance is no longer a luxury; it’s becoming an essential part of responsible pet ownership. From routine checkups to emergency surgeries, pet insurance helps cover unpredictable medical costs, offering peace of mind and enabling pet owners to focus on care, not costs.

According to North American Pet Health Insurance Association (NAPHIA) data, the pet insurance industry has seen a 32% annual growth since 2020. In the UK, the Association of British Insurers (ABI) reports that over 3.4 million pets are now insured — and in Australia, adoption of pet insurance has surged by 18% since 2023.

Key takeaway: September is not just about celebrating pets; it’s a reminder that prevention and protection go hand-in-hand. Whether you’re a new puppy parent or a long-time cat lover, this month is the perfect time to compare plans, secure coverage, and support pet health initiatives in your community.

What Is National Pet Insurance Month & Why It Matters to Responsible Pet Owners

National Pet Insurance Month serves a dual purpose: celebrating our beloved companions and educating owners about financial preparedness for veterinary care. Many pet owners underestimate the potential cost of illnesses or accidents. A single surgery, such as a torn ACL repair for a dog, can cost $3,000 to $6,000, while cat owners might face $2,000 or more for emergency treatments.

During Pet Insurance Month, veterinary clinics, shelters, and pet influencers collaborate to promote awareness through webinars, community events, and educational campaigns. The goal? To make pet insurance accessible and understandable for every owner.

| Pet Insurance Month Benefits | Description |

| Awareness | Promotes responsible pet ownership |

| Affordability | Highlights ways to save on pet care |

| Protection | Encourages financial security for emergencies |

| Advocacy | Supports local shelters and wellness drives |

Micro-CTA: Explore your local veterinary association’s events this September and ask for a free pet insurance quote to see how much you could save in 2025.

Result: More coverage means fewer pets abandoned due to medical costs — and a stronger bond between pets and owners.

How Pet Insurance Works: A Complete Guide for Tier One Pet Parents

Understanding how pet insurance functions is key to choosing the right policy. Unlike human health insurance, pet insurance reimburses you after you’ve paid the vet bill. You submit a claim, and the insurer reimburses a percentage based on your plan’s coverage.

Here’s how it typically works across Tier One markets:

| Step | Process | Average Time (2025) |

| 1 | Visit vet and pay upfront | Immediate |

| 2 | Submit claim via app or email | 1–2 days |

| 3 | Review and approval | 3–5 business days |

| 4 | Reimbursement deposited | 7–10 business days |

Key Tip: Choose a provider with direct vet payments (common in the UK and Australia) to avoid cashflow stress.

For American and Canadian pet owners, policies often cover accidents, illnesses, dental care, and preventive treatments. Many insurers now include wellness add-ons like flea prevention and annual vaccines.

Explore more details here → Compare top providers like Trupanion, Spot, and Lemonade for instant online quotes and 2025 discounts.

Why September Is National Pet Insurance Awareness Month — And How to Get Involved

September was designated as National Pet Insurance Awareness Month to coincide with back-to-school season, when families re-evaluate budgets and coverage options. It’s a strategic time to remind pet owners that prevention is smarter (and cheaper) than reaction.

During this month, many insurance providers offer limited-time discounts and charity partnerships — donating portions of premiums to animal welfare causes.

How to Participate:

- Share your pet’s insurance story on social media using hashtags like #PetInsuranceMonth or #ProtectYourPet2025

- Attend veterinary awareness events in your local area

- Encourage friends and family to get free quotes

Case Study:

In 2024, a Canadian animal hospital partnered with a local insurer, running a “Healthy Pet, Happy Home” campaign. Result: 37% increase in pet insurance enrollments in just one month.

Micro-CTA: Check your regional pet insurer’s site for special September campaigns — you might qualify for 10–15% off your first policy.

Educating Clients About Pet Insurance: A Must for Modern Veterinary Practices

Veterinarians are now front-line educators in the pet insurance movement. Modern clinics understand that clients often face “sticker shock” when confronted with large vet bills. Educating them early prevents financial stress and improves compliance with treatment plans.

Veterinary practices that integrate pet insurance discussions into first visits see higher retention rates and more consistent follow-up care.

| Vet Practice Strategy | Benefit |

| Discuss insurance during puppy/kitten visits | Builds trust and awareness |

| Provide brochures or QR links | Simplifies client education |

| Partner with insurers | Offers referral benefits |

| Host Pet Insurance Month workshops | Strengthens community relationships |

Key takeaway: A pet insured early in life is less likely to face care delays. For clinics, this means happier clients — and healthier pets.

Top Pet Insurance Providers Compared: Coverage, Cost & Customer Value (2025 Edition)

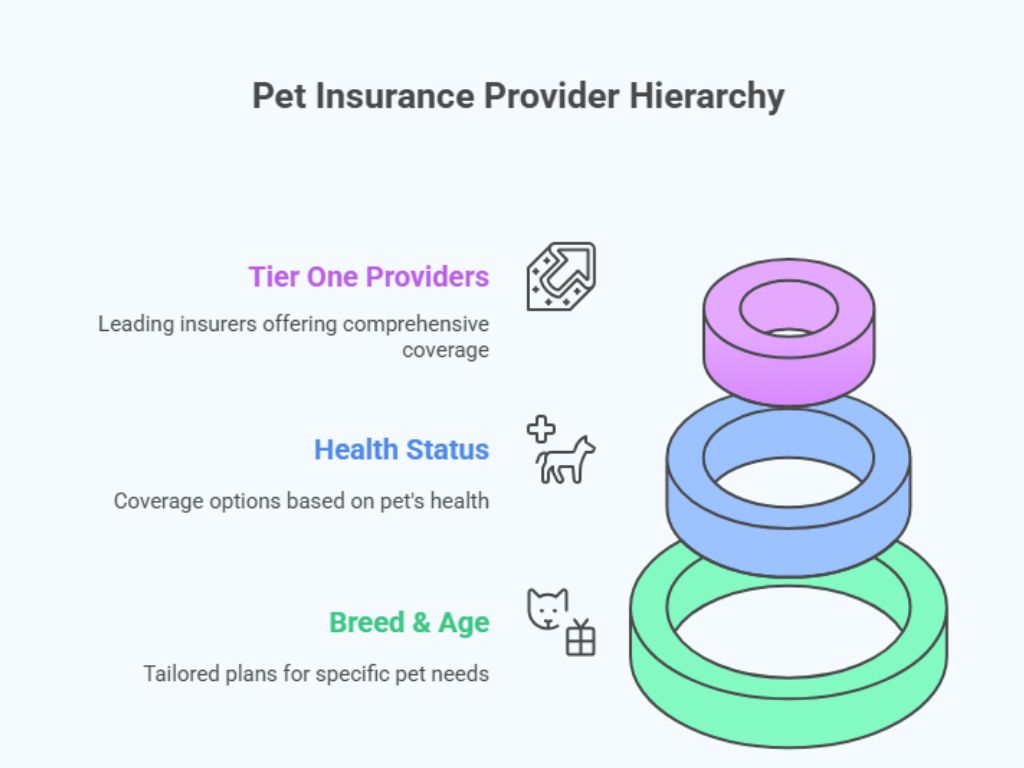

Choosing the right insurer depends on your pet’s breed, age, and health status. Here’s a 2025 comparison of leading Tier One providers:

| Provider | Avg. Monthly Cost (Dog) | Avg. Monthly Cost (Cat) | Reimbursement | Highlights |

| Trupanion (US/CA) | $58 | $35 | 90% | Direct vet payments |

| Lemonade (US/UK) | $45 | $30 | 70–90% | Fast app-based claims |

| Petplan (UK) | £35 | £22 | 90% | Chronic condition coverage |

| Bow Wow Meow (AU) | AUD 52 | AUD 33 | 80% | Lifetime cover options |

Expert Insight: Dr. Sarah Nguyen (Sydney Vet Clinic) says, “Pet insurance isn’t about if you’ll need it — it’s about when. Chronic issues like allergies or arthritis are almost inevitable with age.”

Micro-CTA: Use an online comparison tool to filter policies by reimbursement rate, deductible, and lifetime limit.

Annual Deductible Explained: How It Impacts Your Pet Insurance Premiums

The deductible is the amount you pay before insurance starts covering costs. In 2025, most plans offer annual deductibles ranging from $100–$1,000.

Example:

If your deductible is $250 and your vet bill is $2,000, you pay $250 first, and the insurer covers the remaining $1,750 based on your reimbursement rate.

| Deductible | Monthly Premium | Recommended For |

| $100 | Higher | Frequent vet visits |

| $500 | Moderate | Average care needs |

| $1,000 | Lower | Healthy young pets |

Key Tip: Choose a deductible that matches your pet’s expected medical frequency. Lower deductibles mean higher premiums — but less out-of-pocket surprise.

Average Pet Insurance Cost by Breed, Age & Country (US, UK, Canada, Australia)

Pet insurance costs vary dramatically by breed and location. Bulldogs and Ragdoll cats, for example, have higher premiums due to hereditary conditions.

| Country | Avg. Monthly (Dog) | Avg. Monthly (Cat) |

| US | $53 | $29 |

| UK | £34 | £21 |

| Canada | CA$47 | CA$28 |

| Australia | AUD 50 | AUD 31 |

Result: Older pets (7+ years) can see up to 60% higher premiums, but many plans allow lifetime renewals if coverage begins early.

Explore more details here → Use multi-country quote tools to see rates tailored to your ZIP or postcode.

Best Pet Insurance for Dogs & Cats with Chronic Conditions

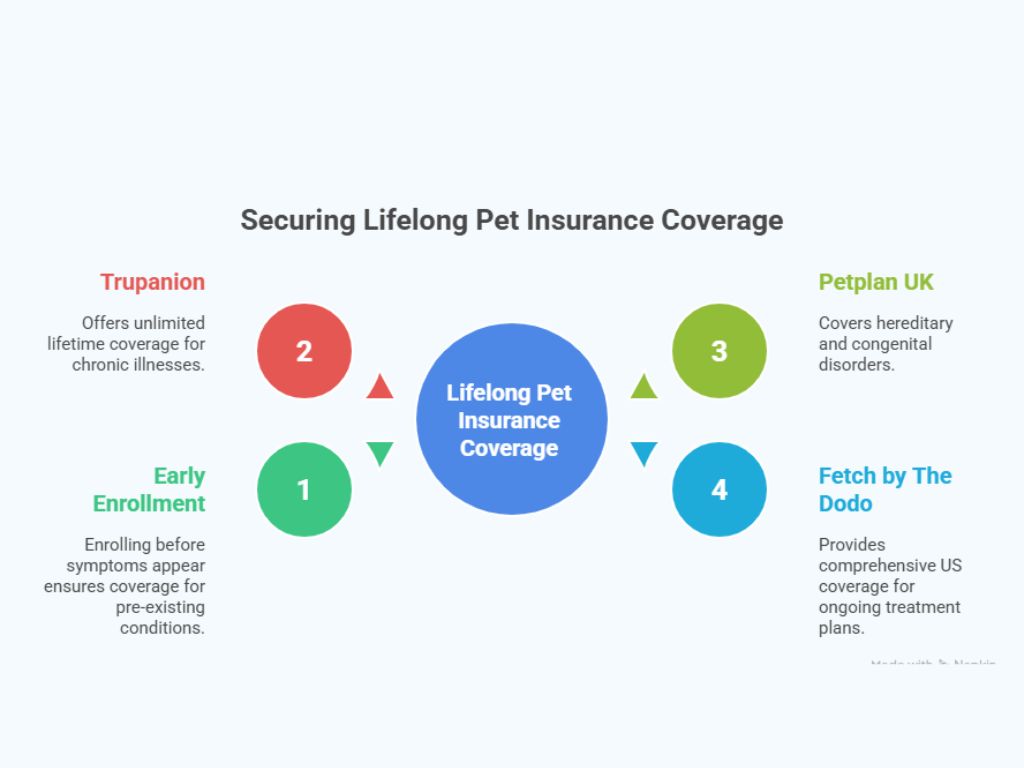

Pets with ongoing issues like diabetes, arthritis, or heart disease need continuous coverage. Plans that exclude pre-existing conditions can be tricky — that’s why early enrollment is key.

Top choices in 2025 include:

- Trupanion: Unlimited lifetime coverage for chronic illnesses.

- Petplan UK: Covers hereditary and congenital disorders.

- Fetch by The Dodo: Comprehensive US coverage for ongoing treatment plans.

Key Takeaway: Insure before symptoms appear — it’s the smartest way to secure coverage for lifelong care.

How to Choose the Right Pet Insurance Plan: Step-by-Step Guide for New Pet Owners

- Assess your pet’s needs: Breed, age, and lifestyle.

- Compare providers: Look for transparency in coverage limits.

- Check exclusions: Avoid policies that exclude common hereditary issues.

- Review claim process: Read customer reviews on payout times.

- Enroll early: Puppies and kittens get the best rates.

Micro-CTA: Visit a trusted comparison portal to see your top 3 quotes in under 60 seconds.

What to Know About Reimbursement Rates & Claim Processes in 2025

Reimbursement rates (usually 70–90%) define how much of your vet bill the insurer covers. Higher rates mean higher monthly premiums — but greater peace of mind.

Modern providers now offer digital claim submission via mobile apps, cutting approval times by up to 40%.

Pro Tip: In 2025, look for insurers offering instant claim tracking and same-week reimbursements — standard in Canada and the UK.

Spring Allergies in Pets: What to Watch For & How Pet Insurance Helps Cover Treatment

Spring brings pollen — and itchy pets. Allergies can lead to chronic skin infections and require costly allergy testing or prescription medication.

Pet insurance helps cover diagnostic tests and recurring treatments like Apoquel or Cytopoint, which can exceed $1,000 annually.

Key Tip: Choose a plan that covers chronic conditions so seasonal allergies won’t become a budget burden.

How to Become a Monthly Donor for Pet Health Awareness Causes

Want to make an impact beyond your pet? Join monthly donor programs supporting pet rescue and wellness education.

Organizations like Humane Society International and RSPCA offer donation plans starting at $10/month.

Micro-CTA: Sign up this September and receive a “Pet Protector” badge — a symbol of your commitment to animal health equity.

Do I Really Need Pet Insurance? Real Stories from US Pet Owners Who Saved Thousands

Real-life case: Lisa from California faced a $5,200 surgery for her golden retriever’s ACL tear. Her policy covered 90%, saving her $4,680.

Result: Without insurance, many owners would resort to credit cards or loans. With it, treatment decisions become easy and stress-free.

Key takeaway: You never plan an emergency — but pet insurance ensures you’re ready when it comes.

Case Study: How Pet Insurance Helped an Australian Family Cover a $7,000 Vet Bill

In Sydney, the Johnson family’s Border Collie, Max, needed emergency stomach surgery. The vet bill? $7,000 AUD. Their Bow Wow Meow plan reimbursed 80%, saving them $5,600.

Tiny Table:

| Cost | Reimbursed | Out-of-Pocket |

| $7,000 | $5,600 | $1,400 |

Takeaway: Early coverage means quick relief — emotionally and financially.

Best Pet Insurance in New Hampshire (2025 Review & Comparison)

Pet insurance popularity in New Hampshire has grown 25% since 2023. Top local picks include:

- Spot Pet Insurance: Best for flexibility

- Embrace: Best accident & illness coverage

- ASPCA: Trusted nationwide network

Average cost: $48/month for dogs, $29 for cats — with up to 90% reimbursement.

Why Vets in the UK and Canada Recommend Early Enrollment for Pet Insurance

UK and Canadian vets emphasize early enrollment because many plans exclude pre-existing conditions.

Example: A kitten insured at 8 weeks old can access lifetime illness coverage. The same cat insured at 2 years may lose eligibility for congenital issues.

Result: Early coverage secures your pet’s lifelong protection and the lowest possible premium.

FAQ: Essential Cookies & Compliance in Online Pet Insurance Enrollment Forms

Pet insurers must comply with GDPR (UK/EU) and CCPA (US) privacy laws. Essential cookies help store form data securely during enrollment.

Tip: Always review an insurer’s cookie and privacy policies before submitting personal details online.

Dr. Emily Roberts, DVM (USA): “Pet Insurance Awareness Month Is a Wake-Up Call for Pet Health Equity”

Dr. Roberts notes that over 60% of uninsured pets in the US come from middle-income households. Awareness month is about bridging that gap, ensuring every pet can access medical care when it matters most.

Animal Talk | September 2025: The Real Impact of National Pet Insurance Month

National Pet Insurance Month leads to a measurable spike in enrollments and donations every September. Media campaigns and influencer collaborations help sustain this growth well into the next year.

4 Myths About Pet Insurance — Debunked by Top Canadian Veterinarians

- “It’s too expensive” — Most plans cost less than $2/day.

- “It’s not worth it” — Average claim in Canada exceeds CA$900.

- “Pre-existing conditions never covered” — Some providers now offer partial coverage.

- “Claims take forever” — 2025 apps reduce approval to under a week.

Dr. Randy & Beth (UK Vet Network): “Pet Insurance Empowers Vets to Provide Better Care”

According to UK vets Randy & Beth, insured clients are 3x more likely to approve recommended procedures. This empowers clinics to offer optimal treatment — not cost-cut corners.

Pet Insurance Data Insight 2025: 68% of Pet Owners in Australia Still Lack Coverage

Despite rising awareness, most Australian pet owners remain uninsured. However, with rising vet costs and social media advocacy, experts predict a 15% adoption increase by 2026.

Industry Report: How Pet Insurance Month Drives Annual Adoption Growth by 32%

Industry data confirms that targeted September campaigns increase new policy enrollments by up to 32% globally. Combined with digital education, this trend is expected to continue through 2025–2026.

FAQ Section (AdSense & SEO Optimized)

Is Pet Insurance Worth It in 2025?

Absolutely. Pet insurance remains one of the smartest financial decisions for owners in 2025. Veterinary costs have risen 12–18% across Tier One markets, making coverage vital for emergencies and chronic conditions. With flexible deductibles and 90% reimbursement options, it’s a small monthly investment that can save thousands annually.

What Is the Best Pet Insurance for Dogs & Cats?

Top-tier choices include Trupanion, Lemonade, and Petplan. Trupanion leads for unlimited lifetime benefits, while Lemonade offers low-cost, fast digital claims. Petplan remains a UK favorite for hereditary condition coverage. Always compare policies for reimbursement rates, annual limits, and exclusions before enrolling.

Spot vs. Lemonade Pet Insurance: Which Offers Better Monthly Value?

For tech-savvy owners, Lemonade wins with budget-friendly premiums and a quick claims app. Spot, however, provides wider coverage for older pets and optional wellness add-ons. Lemonade suits younger pets with fewer pre-existing issues; Spot is best for comprehensive, long-term value.

How to Get Free Pet Insurance Quotes Online (US, UK, Canada, Australia)

Visit official insurer websites or aggregator portals like Policygenius, Compare the Market, or Finder. Enter your pet’s details to receive multiple quotes instantly. Tip: Run comparisons during Pet Insurance Month (September) — many providers offer limited-time sign-up discounts of up to 15%.

Pet Insurance Comparison: Find the Right Coverage for Your Budget

Start by identifying your must-haves: accident-only, illness, or comprehensive care. Then, use an online calculator to adjust deductibles and reimbursement levels. Comparing at least three providers ensures you get optimal balance between monthly cost and total coverage value.

Creative Pet Insurance Month Ideas for Clinics & Influencers

Clinics can host “Insure Your Pet” events with free wellness checks, while influencers can share pet rescue stories using #PetInsuranceMonth. Collaborate with local shelters to promote affordable coverage and giveaways — boosting both awareness and engagement online.

Does Pet Insurance Cover Surgeries & Preventive Care?

Most full-coverage plans include surgeries, hospitalization, and diagnostic imaging. Preventive care (like vaccines or dental cleanings) is often available as an add-on. Always verify your policy’s terms — accident-only plans typically exclude preventive services.

What Is Group Pet Insurance and How Can Employers Benefit?

Group pet insurance is an emerging employee benefit where companies negotiate bulk rates for staff. It boosts retention and morale, especially in pet-friendly workplaces. Employers gain goodwill, while workers enjoy 10–20% lower premiums and simplified enrollment.

Unlimited Pet Insurance Coverage — Is It Worth the Premium?

Yes, for high-risk breeds or older pets. Unlimited coverage eliminates lifetime or annual caps, providing complete peace of mind. Though monthly premiums are higher, owners avoid unexpected out-of-pocket expenses for chronic or repeated medical conditions.