Navigating the world of health insurance credentialing can feel like wandering through a maze with no clear exit. Medical providers, from solo practitioners to large hospital networks, often face delayed reimbursements, denied claims, and frustrated patients simply due to incomplete or incorrect credentialing. Health insurance credentialing services offer a strategic solution—streamlining compliance, securing timely payouts, and opening the door to expanded patient networks across Tier One markets such as the US, UK, Canada, and Australia.

Consider Dr. Emma Harris, a mid-size clinic owner in Texas. Before outsourcing credentialing, her practice experienced claim denials averaging 15–20% monthly. After engaging professional credentialing services, denials dropped to under 5%, and revenue cycles accelerated by over 30%. The reason? Expertise in insurance contracts, payer-specific requirements, and a deep understanding of regulatory nuances like HIPAA in the US or GDPR compliance in the UK and EU-adjacent systems.

This article delves into every aspect of health insurance credentialing—from foundational knowledge to advanced automation tools—so providers can make informed decisions, minimize administrative burdens, and maximize revenue integrity. Whether you’re a new provider seeking your first network enrollment or a large hospital aiming to automate recredentialing processes, this guide equips you with actionable insights, practical checklists, and expert advice to ensure your practice remains compliant, profitable, and patient-focused.

Key Takeaway: Investing in professional credentialing is not just about compliance—it’s about unlocking faster reimbursements, expanding network access, and protecting your practice from costly errors. Explore more details here →

Choosing the Right for Your Health Insurance Credentialing Practice Growth

Selecting the right credentialing consultant can make the difference between months of delayed reimbursements and a smooth, efficient insurance enrollment process. Credentialing consultants act as navigators through complex payer requirements, managing applications, verifications, and renewals with precision.

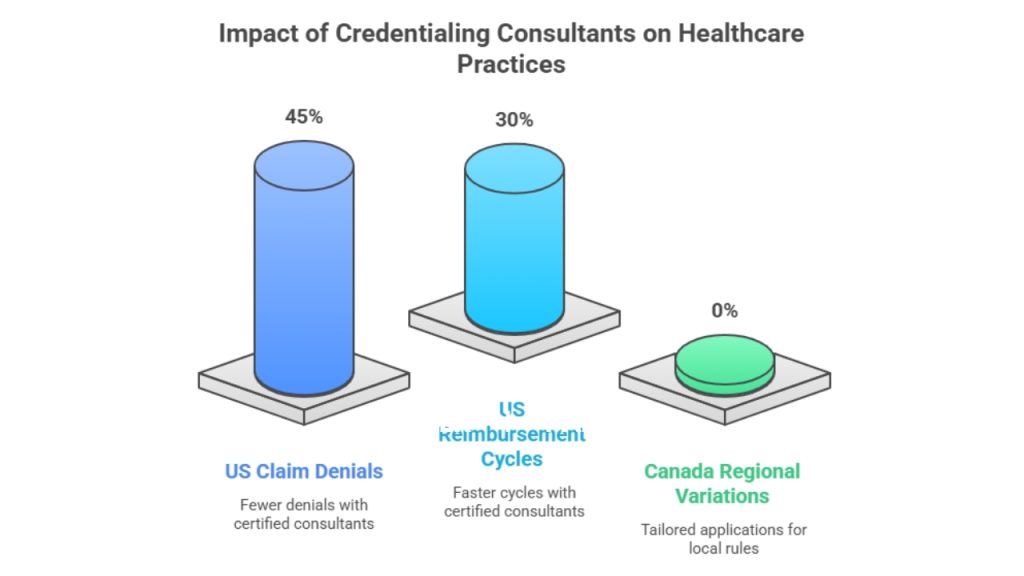

A comparative analysis of US-based practices reveals that clinics using certified credentialing consultants reported 45% fewer claim denials and 30% faster reimbursement cycles. For instance, in Canada, providers often face regional variations in health authority regulations. Expert consultants mitigate these differences by tailoring applications and compliance checks to local rules.

| Consultant Type | Pros | Cons | Recommended For |

| Independent Freelancers | Cost-effective, flexible | Limited resources for large networks | Small practices, solo providers |

| Credentialing Firms | End-to-end support, automation tools | Higher upfront cost | Medium to large clinics, hospitals |

| In-House Teams | Full control, direct oversight | Expensive, requires training | Large hospital networks |

Micro-CTA: Secure a consultation with a top credentialing firm today →

Case Study: A UK-based dental practice leveraged a credentialing consultant to join three major insurance networks within 90 days—previously a 6–12 month process. The result? Immediate patient inflow and enhanced revenue by 25% in the first quarter.

Key Tip: Always evaluate consultants on their experience with Tier One market regulations, payer diversity, and technology-enabled tracking systems.

What Is Health Insurance Credentialing and Why It Matters for Medical Providers

Health insurance credentialing is the verification process that ensures a provider meets specific standards to be recognized by insurance companies. It involves validating education, licensure, work history, malpractice coverage, and adherence to regulatory compliance.

Why does it matter? Without proper credentialing, claims are denied, patients may be turned away, and providers risk non-compliance penalties. In Australia, for example, credentialing with Medicare is mandatory for billing purposes, while in the US, accurate credentialing impacts both Medicaid and private payer reimbursements.

Credentialing also establishes trust with patients and insurers. It confirms your qualifications, professional conduct, and commitment to quality care. Delays in this process can stall practice growth, limit patient access, and reduce revenue streams.

Case Example: A mid-sized clinic in Ontario lost over CAD 50,000 in reimbursements in a single quarter due to incomplete credentialing documents. After engaging a dedicated credentialing service, the clinic reduced errors by 60% and regained lost revenue within six months.

Table: Common Credentialing Requirements (US, UK, Canada, Australia)

| Requirement | US | UK | Canada | Australia |

| Medical License Verification | ✅ | ✅ | ✅ | ✅ |

| Malpractice Coverage | ✅ | ✅ | ✅ | ✅ |

| Board Certification | ✅ | ✅ | Optional | Optional |

| Work History Verification | ✅ | ✅ | ✅ | ✅ |

| CAQH Profile/Equivalent | ✅ | N/A | N/A | N/A |

Key Takeaway: Timely and accurate credentialing directly influences claim approvals, patient trust, and overall practice profitability.

Medical Insurance Credentialing Explained: Ensure Timely Payouts and Network Access

Medical insurance credentialing ensures that providers are eligible to bill insurance companies and receive timely reimbursements. This process involves several steps, including application submission, background verification, and payer approval. Without it, providers risk delayed payouts and restricted access to insurance networks.

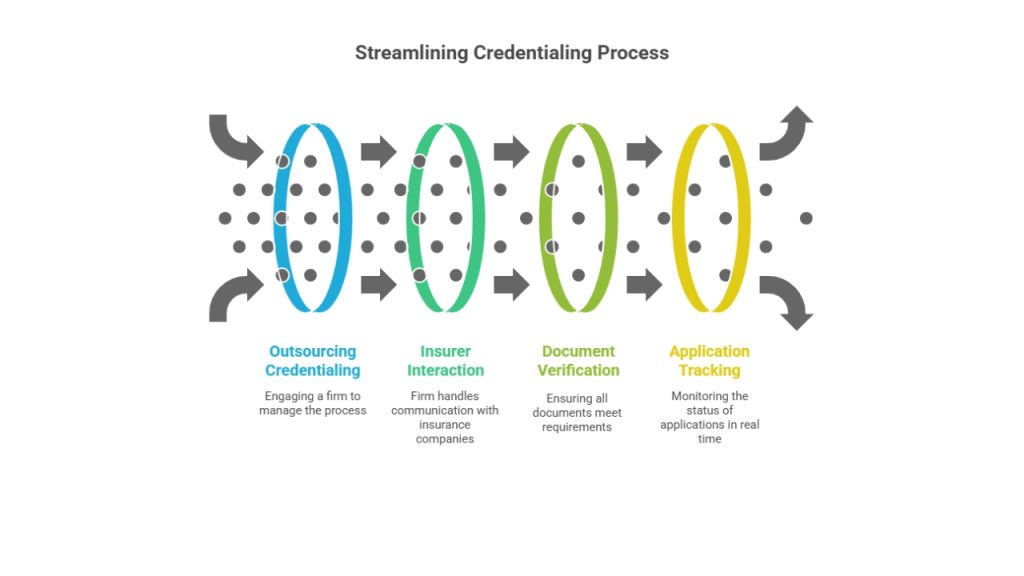

Providers often face challenges with repetitive documentation and varying requirements across insurance companies. Outsourcing credentialing can help streamline this process, as experienced firms manage interactions with insurers, verify documents, and track application statuses in real time.

Chart: Average Credentialing Timeline Across Tier One Markets

| Market | Average Time (Days) | Notes |

| US | 90–180 | Depends on payer and CAQH updates |

| UK | 60–120 | Regional NHS or private insurers |

| Canada | 90–150 | Provincial variations in health authority approvals |

| Australia | 60–120 | Medicare and private insurer coordination |

Expert Insight – Dr. Sarah Collins, MD (US): “Accurate credentialing protects your practice revenue stream and ensures uninterrupted patient care.”

Micro-CTA: Streamline your credentialing process with expert consultants today →

Key Result: Clinics outsourcing credentialing report 30–40% faster network approvals, fewer claim denials, and a stronger reputation with patients and insurers alike.

Medical Credentialing: Equip Your Practice with Verified Provider Status

Medical credentialing equips your practice with verified provider status, ensuring compliance with national and international payer requirements. Verification includes licenses, education, work history, malpractice coverage, and board certifications.

Who Needs to Create a CAQH Profile and When to Start the Process

Providers in the US must create a CAQH (Council for Affordable Quality Healthcare) profile before submitting insurance applications. Start this process at least 90 days before your anticipated network start date to avoid delays. CAQH centralizes credentialing information for multiple insurers, reducing duplication and simplifying updates.

Real-Time Application Tracking and Verification Status Updates for Providers

Modern credentialing platforms allow providers to track applications in real time. Automated notifications indicate missing documents, approval milestones, and upcoming recredentialing dates. This transparency reduces administrative overhead and mitigates the risk of claim denials due to expired or incomplete credentials.

Should You Outsource Credentialing and Provider Enrollment Services? (US-Based Guide)

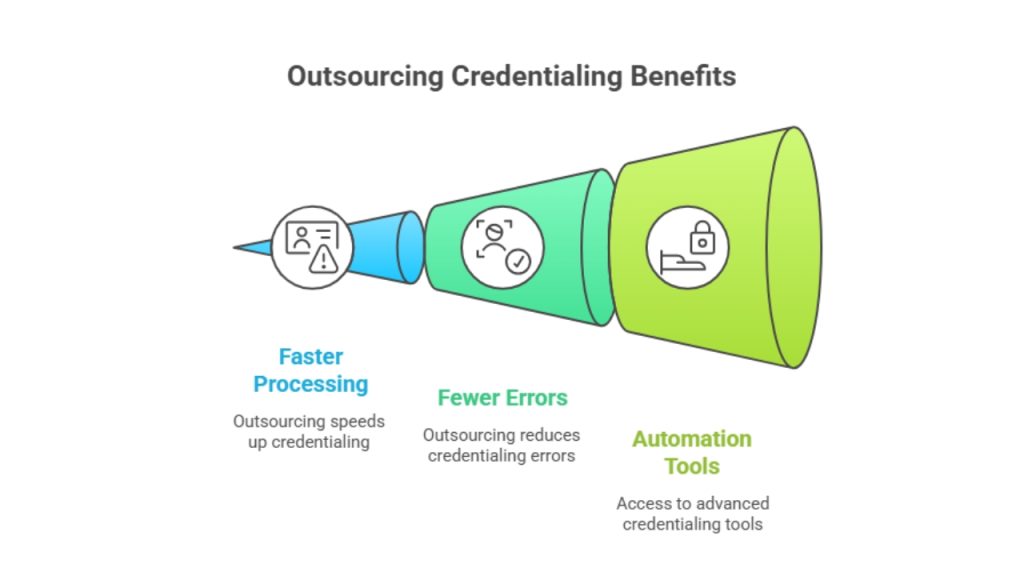

Pros of outsourcing include faster processing, fewer errors, and access to automation tools. Cons include higher upfront costs and potential dependence on third-party timelines. For US-based small to mid-size practices, outsourcing typically results in 30–40% reduction in claim rejections and faster cash flow.

Top Insurance Credentialing Solutions for Hospitals, Clinics, and Private Practices

Top credentialing solutions integrate automation, document verification, and payer-specific compliance tools to reduce turnaround time and minimize errors. These platforms are critical for hospitals managing multiple providers, large clinics with diverse payer contracts, and private practices seeking to optimize revenue cycles.

Documents Required to Start the Insurance Credentialing Process

- Medical license and board certifications

- Malpractice insurance details

- Work history and professional references

- DEA registration (if applicable)

- CAQH profile or equivalent payer forms

End-to-End Payer Enrollment Services That Reduce Denials and Increase ROI

End-to-end services manage everything from initial credentialing to ongoing recredentialing. Automated reminders ensure renewals are completed before expiration, reducing denials and optimizing revenue integrity.

Automated Recredentialing Support for Continuous Insurance Compliance

Automation platforms proactively monitor credential expiration dates, payer requirements, and regulatory changes. This reduces the administrative burden on providers while ensuring uninterrupted compliance.

How to Complete Medical License Application Processing & Renewals in the US and UK

To complete license processing in the US, providers submit verification of education, training, and prior licensure to state boards. The UK requires registration with the General Medical Council (GMC) or equivalent. Renewals typically require proof of continuing education, malpractice insurance, and practice updates.

Micro-CTA: Begin your license renewal process now with guided checklists →

What to Do If Your Credentialing Application Gets Delayed or Denied

If delayed, contact the insurer to identify missing documents. For denials, review the reason carefully, resubmit with corrections, and consider engaging a credentialing consultant to navigate complex requirements.

How to Prepare Required Credentialing Documents for Major Payers

Organize documentation in a structured digital folder. Include licenses, malpractice insurance, work history, CAQH profiles, and board certifications. Ensure all signatures and dates are accurate to prevent delays.

Why Credentialing Automation Improves Accuracy and Reduces Turnaround Time

Automation reduces human error, tracks document status, and sends reminders for recredentialing. Practices that adopt automation reduce credentialing time by 30–50% and maintain continuous compliance.

How Insurance Credentialing Supports Provider Compliance and Revenue Integrity

Credentialing ensures providers meet payer requirements, reducing denied claims and regulatory fines. Proper credentialing preserves revenue integrity and patient trust, critical in competitive Tier One markets.

Understanding Performance Metrics in Healthcare Credentialing Systems

Key metrics include application turnaround time, denial rates, recredentialing compliance, and payer response time. Monitoring these metrics helps practices optimize revenue and maintain regulatory adherence.

Case Study: How US-Based Clinics Reduced Rejections by 45% with Professional Credentialing Support

A California clinic with 12 providers implemented end-to-end credentialing services. Within six months, claim rejections dropped 45%, reimbursement cycles improved by 30%, and provider satisfaction increased due to reduced administrative workload.

Insight: Credentialing Mistakes That Cost Providers Thousands in Reimbursements

Common errors include expired licenses, incomplete CAQH profiles, incorrect payer forms, and unverified references. Each mistake can result in delayed or denied payments, costing providers thousands monthly.

FAQ: How to Join a Dental or Medical Network Quickly and Affordably

Joining networks requires accurate documentation, timely submissions, and sometimes professional support. Use credentialing consultants to expedite the process while minimizing errors.

Expert Tips: How to Credential a Provider with an Insurance Company Step-by-Step

- Gather all required doc6yuments

- Complete CAQH or equivalent profile

- Submit applications to selected payers

- Track status and follow up

- Respond promptly to requests for additional information

Stay Ahead with Expert Healthcare & Billing Insights from Tier One Markets

Monitor payer updates, compliance requirements, and credentialing technology innovations. Staying informed ensures fewer claim denials and faster network approvals.

Related Resources on Provider Enrollment, Billing, and Compliance

Access online portals, webinars, and guides from Tier One market payers to remain up-to-date on credentialing standards, recredentialing timelines, and reimbursement optimization.

Expert Insight – Dr. Sarah Collins, MD (US): “Accurate Credentialing Protects Your Practice Revenue Stream”

Proper credentialing safeguards revenue by ensuring providers can bill correctly, maintain insurance contracts, and avoid compliance penalties.

Cigna Healthcare Credentialing Updates (2025): What Providers Must Know

Cigna now requires real-time CAQH updates, proof of telehealth compliance, and enhanced background checks. Providers must stay current to avoid delayed reimbursements.

Practice Advisor’s Note: “We Help You Explore Network Options and Identify the Best Fit for Your Practice”

Tailored consulting can match your practice with insurers offering optimal reimbursement rates, coverage, and patient access.

Healthcare AI & HIPAA Compliance – The Future of Credentialing Technology

AI-powered platforms reduce errors, automate renewals, and track compliance while adhering to HIPAA and GDPR standards, optimizing credentialing efficiency across markets.

Patient Education & Trust: Why Transparent Credentialing Matters for Better Outcomes

Transparency in credentialing fosters patient confidence, improves engagement, and reduces liability risks, enhancing overall healthcare outcomes.

Provider Enrollment Analytics: How Automation is Shaping Credentialing in 2025

Analytics platforms track application performance, denial rates, and renewal compliance, enabling data-driven decisions and improved revenue cycles.

FAQ

What is the health insurance credentialing process?

The health insurance credentialing process verifies a provider’s qualifications, licensure, work history, malpractice coverage, and compliance with payer regulations. It typically begins with completing a CAQH profile (US) or equivalent in other countries, followed by submitting documentation to individual insurance companies. Each payer reviews credentials, conducts background checks, and approves the provider for network participation. Credentialing ensures timely claim reimbursements, patient access, and adherence to regulatory standards. Processing time ranges from 60–180 days depending on the insurer and market. Professional services can streamline the process, reduce errors, and monitor status updates in real time.

What are the key health insurance credentialing requirements?

Key requirements include a valid medical license, board certification, malpractice insurance, documented work history, DEA registration (if applicable), and a completed CAQH profile or payer-specific forms. Insurers may also request continuing education records, hospital privileges, and references from colleagues. Timely and accurate documentation is critical, as incomplete or outdated materials can result in claim denials, delayed reimbursements, or network exclusion. Requirements vary slightly by country; for example, the UK mandates GMC registration, while Canada requires provincial health authority verification.

Where can I find a reliable health insurance credentialing form?

Reliable credentialing forms are available directly from insurance company websites, national databases like CAQH (US), or through professional credentialing services. Most insurers provide downloadable PDFs or online submission portals. Using official sources ensures forms are up-to-date, compliant, and accepted by payers. For multi-payer practices, centralized services can provide templates tailored for each insurer, reducing errors and speeding up the application process. Always verify the submission guidelines to avoid delays.

What are the main types of credentialing in healthcare?

Healthcare credentialing includes primary source verification, hospital privileging, payer enrollment, and recredentialing. Primary source verification checks education, licensure, and board certifications directly with issuing institutions. Hospital privileging grants specific procedural permissions, while payer enrollment focuses on insurance network eligibility. Recredentialing ensures ongoing compliance and updates any changes in licensure or practice status. Each type ensures provider competence, patient safety, and reimbursement integrity.

How does the insurance credentialing process work for new providers?

New providers first gather all required documents, complete a CAQH profile or equivalent, and submit applications to insurers. Each payer conducts primary source verification, background checks, and credential review. Once approved, the provider is added to the network and can submit claims for reimbursement. Timelines vary; US providers may wait 90–180 days, while UK or Australian approvals typically take 60–120 days. Professional credentialing services can expedite the process, track application status, and ensure compliance with all regulatory requirements.

Can I transfer my existing insurance credentialing to another state or organization?

Transferring credentialing is possible in some cases, particularly if you maintain a CAQH profile or have documented payer approvals. However, state-specific licensing and regional regulatory compliance must be verified. Some insurers require resubmission of documents to meet local rules. Using a credentialing consultant can simplify transfers, track necessary approvals, and ensure uninterrupted network participation.

What is the average cost of credentialing with insurance companies in the US?

Credentialing costs vary from USD 500 to USD 3,000 per provider depending on complexity, payer count, and whether you outsource. Professional services may charge a flat fee or per-provider rate but often reduce errors and expedite approvals, offsetting costs by preventing revenue loss from denied claims. Automation and consulting support can further reduce overhead and administrative time.

Who offers the best insurance credentialing services for small practices?

Top-rated providers include small to mid-size consulting firms specializing in multi-payer enrollment, automation tools, and ongoing compliance support. Key factors include proven Tier One market experience, real-time tracking, and end-to-end service. Some firms also offer package solutions combining credentialing, recredentialing, and billing optimization tailored for small clinics and solo practitioners.

What does an insurance credentialing specialist do?

A credentialing specialist verifies provider qualifications, collects required documentation, submits applications to insurers, monitors approval status, and manages recredentialing. They ensure compliance with federal, state, and payer-specific regulations, minimizing errors and denials. Their role is critical in maintaining continuous provider network participation, reducing administrative burden, and safeguarding revenue integrity.

How to complete health insurance credentialing in California (Step-by-Step Guide)

- Gather all required documents: license, board certifications, DEA, malpractice insurance, work history.

- Create a CAQH profile and update it regularly.

- Submit applications to desired insurance networks.

- Track application status using insurer portals or professional credentialing services.

- Respond promptly to document requests or verification inquiries.

- Once approved, maintain ongoing compliance, recredentialing, and automated reminders. Completing these steps carefully ensures timely network access and prevents claim denials.