Running a home health business is rewarding, but it also comes with significant risks. From accidental patient injuries to allegations of negligence, caregivers and home health agencies face challenges that can damage both finances and reputation. Without proper coverage, one unexpected lawsuit could wipe out years of hard work. This is why Home Health Business Insurance has become not just an option, but a necessity for providers in Tier One markets including the US, UK, Canada, and Australia.

Consider this scenario: a caregiver in Los Angeles slips while assisting a patient, resulting in injuries that lead to costly hospital bills and a lawsuit. Or imagine a small home care agency in Toronto being accused of mishandling medication—claims like these often cost tens of thousands in legal defense fees alone. With affordable liability coverage, these businesses can focus on what truly matters: delivering high-quality care without constant fear of financial loss.

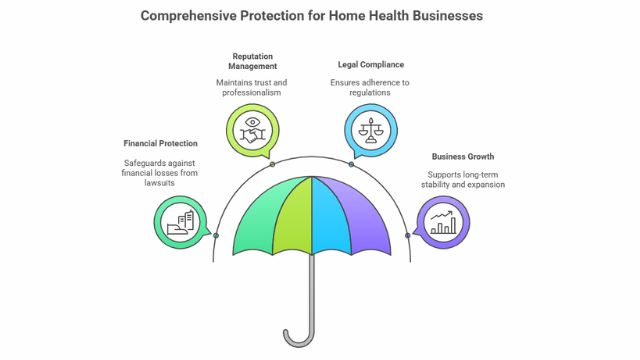

Insurance acts as both a safety net and a business growth strategy. By securing the right policies, agencies demonstrate professionalism, gain trust from clients, and comply with local regulations. Whether you’re a sole caregiver in Sydney or managing a 50-staff agency in London, the right business insurance plan protects not just your patients but also your livelihood.

Key Takeaway: Insurance for home health businesses is more than compliance—it’s an investment in stability, trust, and long-term growth. Explore your options today →

Why Do Caregivers Need Insurance for Home Health Services?

Caregivers are on the frontlines of health care, working in people’s homes where risks are unpredictable. Unlike hospitals or nursing facilities, home environments are less controlled, making accidents more likely. From patient falls to property damage, caregivers need protection against claims that could otherwise bankrupt their business.

In the US, over 40% of lawsuits against caregivers involve alleged negligence. In Canada, a single malpractice claim can exceed $75,000 in defense costs. Meanwhile, in the UK, public liability insurance is often mandatory for agencies providing domiciliary care. These realities make insurance a shield against legal and financial threats.

| Risk | Potential Claim | Estimated Cost (Tier One Markets) |

| Patient injury at home | Liability lawsuit | $50,000–$250,000 |

| Medication error | Professional negligence claim | $75,000–$150,000 |

| Employee injury | Workers’ compensation | $30,000–$100,000 |

| Property damage | Client property repair | $5,000–$25,000 |

Case Example: In Melbourne, an independent caregiver was sued for accidental damage after breaking a patient’s expensive medical equipment. Without insurance, she would have paid $18,000 out of pocket. Her liability policy covered the loss, saving her business.

Result: Insurance ensures caregivers focus on care delivery rather than constant financial fear.

Explore more: Get a personalized insurance quote for caregivers in the US, UK, Canada, or Australia.

Why Insurance for Caregivers Is a Must in Tier One Countries

In Tier One countries, regulations, lawsuits, and compliance requirements are stricter than in developing markets. Caregivers without insurance may struggle to win contracts, especially with government-funded healthcare programs. In the US, many Medicaid and Medicare home health programs require agencies to carry minimum liability coverage. In the UK, the Care Quality Commission (CQC) expects registered providers to maintain active insurance.

For Canadian businesses, clients often demand proof of coverage before signing contracts. Similarly, in Australia, professional indemnity insurance is considered industry standard for allied health providers.

Mini Case Study: A UK-based agency bidding for a contract with a local council was disqualified simply for not showing valid liability insurance. The lost deal cost them nearly £200,000 annually. After purchasing comprehensive coverage, they were approved in the next round and secured the contract.

Key Tip: Insurance isn’t just about protection—it’s about credibility. Agencies that carry coverage win more clients, retain staff, and achieve sustainable growth.

Micro-CTA: Ready to grow your agency? Secure a Tier One-compliant insurance plan today →

Insurance for Home Care Businesses, Home Health Agencies, and Hospices

Home health agencies and hospices face unique challenges compared to independent caregivers. They often employ dozens—or even hundreds—of staff, exposing them to higher risks. Insurance policies must cover:

- General Liability – Protects against injury and property damage claims.

- Professional Liability (Malpractice) – Covers claims of negligence or errors in patient care.

- Workers’ Compensation – Required in most US states for employee protection.

- Cyber Liability – Essential for agencies handling sensitive patient data.

- Commercial Auto – Covers company-owned or caregiver-used vehicles.

| Insurance Type | Why It Matters for Agencies |

| General Liability | Protects against slip-and-fall lawsuits in patient homes. |

| Professional Liability | Covers mistakes in treatment or care plans. |

| Workers’ Comp | Prevents costly lawsuits from injured employees. |

| Cyber Liability | Safeguards against HIPAA breaches and data theft. |

| Auto Coverage | Protects against road accidents during patient visits. |

Insight: Hospices face even greater risks due to the sensitive nature of end-of-life care. Allegations of negligence are common, and without coverage, financial damages can cripple operations.

Result: A comprehensive insurance package safeguards agencies from lawsuits, employee risks, and client claims.

Experts in Home Health Care Provider Insurance Solutions

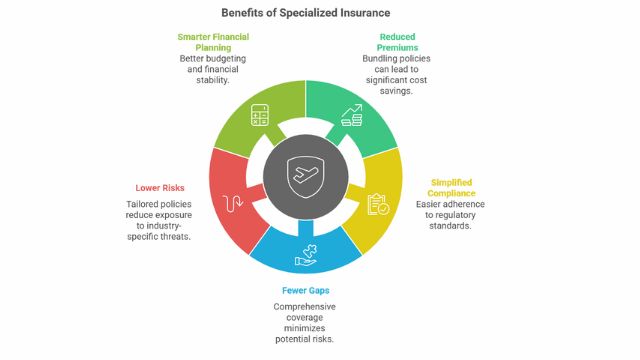

Specialized insurers understand the unique risks of the home health sector. General business insurers may overlook critical aspects like medical malpractice exposure or regulatory compliance requirements. By working with experts, caregivers and agencies access policies tailored to their industry.

In the US, providers like PHLY and CNA specialize in healthcare liability coverage. In the UK, insurers such as Markel and Aviva offer dedicated domiciliary care insurance. Canadian providers like Intact Insurance and HUB International deliver custom policies for caregivers, while in Australia, Allianz and BizCover support small-to-mid-sized agencies.

Mini Case Study: A small home health business in Ontario worked with a specialized broker who bundled liability, workers’ comp, and cyber coverage into one package. This not only reduced premiums by 18% but also simplified compliance.

Key Takeaway: Expert-backed policies mean fewer gaps, lower risks, and smarter financial planning.

Is It Mandatory for Caregivers to Carry Medical Malpractice Insurance in the US & Canada?

Yes—while not always legally mandated for every individual caregiver, medical malpractice insurance is highly recommended and sometimes required by employers or regulatory boards. In the US, states like California and New York strongly encourage coverage for licensed caregivers. In Canada, many provinces expect home care workers affiliated with health networks to carry professional liability insurance.

Pros of Having Coverage:

- Protects against negligence lawsuits.

- Increases trust with clients.

- Helps meet contract requirements.

Cons of Not Having Coverage:

- Personal assets at risk during lawsuits.

- Missed contract opportunities.

- Higher financial stress.

| Scenario | With Coverage | Without Coverage |

| Patient injury lawsuit | Insurance covers $80,000 claim | Caregiver pays out of pocket |

| Medication error | Defense costs covered | Bankruptcy risk |

Expert Insight: “Caregivers without malpractice coverage are one step away from financial disaster. Lawsuits happen more often than people think.” – Insurance Broker, Toronto

Takeaway: Even if not legally required, malpractice insurance is a smart business move.

How Much Does Home Health Caregiver Insurance Cost in the UK, US & Australia?

Insurance costs vary by location, services, and size of operations. On average:

- US: $600–$2,500/year for small caregivers; agencies pay $5,000–$20,000.

- UK: £300–£1,500/year for independent providers; £3,000+ for agencies.

- Australia: AUD $400–$2,000/year for caregivers; larger agencies AUD $10,000+.

| Market | Independent Caregiver | Agency (10+ staff) |

| US | $600–$2,500 | $5,000–$20,000 |

| UK | £300–£1,500 | £3,000–£7,000 |

| Canada | CAD $500–$2,200 | CAD $6,000–$15,000 |

| Australia | AUD $400–$2,000 | AUD $10,000+ |

Cost-Saving Tip: Bundle policies (e.g., liability + cyber + auto) to save up to 20%.

Result: Insurance costs less than one lawsuit.

Getting Insured Is Quick and Easy for Home Health Providers

The process of securing coverage is simpler than most expect:

- Request a free quote online.

- Provide details (services, staff size, annual revenue).

- Compare policies from multiple providers.

- Select coverage that fits compliance and budget needs.

- Get your certificate of insurance within 24–48 hours.

Mini Case Study: A startup agency in Chicago obtained full coverage in just three days, enabling them to apply for government contracts immediately.

Takeaway: Don’t delay insurance—it’s fast, affordable, and crucial.

Home Health Care Insurance Quote Request for Small & Mid-Sized Businesses

Small and mid-sized businesses often struggle to balance cost and coverage. Many insurers now offer custom quote portals that calculate premiums instantly. By answering a few questions about employees, services, and revenue, owners receive tailored estimates.

Pro Tip: Always compare at least three providers. Premiums can vary by 40% for the same coverage.

Explore more details here → Request your free quote today.

What Risks Do Home Health Care Providers Face and How to Protect Your Business?

Home health providers face diverse risks:

- Liability from patient falls or injuries.

- Lawsuits over negligence or medication errors.

- Employee injuries requiring workers’ comp.

- Data breaches from patient records.

Checklist for Protection:

Maintain strong insurance policies.

Train staff in compliance and safety.

Use secure technology for patient data.

Perform regular risk assessments.

Micro-CTA: Protect your agency today with a comprehensive policy package.

How Home Health Business Insurance Safeguards Agencies in Tier One Markets

In Tier One markets, insurance doesn’t just reduce risks—it keeps businesses compliant with legal and industry standards. For example, US agencies often cannot bill Medicare without liability insurance. In the UK, contracts with the NHS require proof of coverage.

Key Takeaway: Insurance is both a compliance requirement and a competitive advantage.

Why Comprehensive Coverage Matters for Growing Home Health Practices

As agencies scale, risks multiply. A caregiver business with three employees faces very different risks than one with thirty. Comprehensive coverage grows with your business, ensuring you’re never underinsured.

Result: Coverage today prevents tomorrow’s bankruptcy.

Would You Rather Discuss This in Person? Connect With a Licensed Insurance Agent

Some decisions are better made with expert guidance. Licensed insurance agents help navigate policy complexity, ensuring coverage matches local laws and unique business needs.

Action Step: Schedule a free consultation with an insurance expert near you.

What Is Home Care Insurance and Why Does Every Agency Need It?

Home care insurance is a tailored policy covering general liability, professional liability, and other business risks for caregivers and agencies. Without it, providers risk lawsuits, financial losses, and loss of client trust.

Takeaway: Every home health agency—no matter how small—needs insurance.

Specialized Coverage for Home Health Care Businesses in the US & UK

Providers in the US and UK face different but equally strict regulations. In the US, HIPAA compliance makes cyber liability critical. In the UK, CQC compliance makes public liability mandatory.

Peace of Mind Insurance Plans – So You Can Focus on Patients, Not Risks

Peace of mind is priceless. Insurance means agencies focus on delivering quality care instead of worrying about lawsuits.

What Are the Costs of Home Care Insurance in Canada, UK & Australia?

Costs vary but average CAD $500–$2,000 for individuals, £300–£1,500 in the UK, and AUD $400–$2,000 in Australia.

What Types of Business Insurance and Bonds Do Personal Care Providers Need?

Personal care providers often need liability, malpractice, and fidelity bonds to protect against theft or negligence claims.

Home Health Caregiver Insurance Resources for Tier One Providers

Trusted associations like the National Association for Home Care & Hospice (NAHC) in the US, UKHCA in the UK, and Home Care Ontario provide resources for providers.

Get the Best Insurance Quote Online in Just a Few Clicks

Modern platforms simplify the process—enter your details, compare providers, and get covered instantly.

PHLY Industry Survey: How Do Care Providers Prefer to Communicate With Carriers?

According to PHLY’s 2024 survey, 62% of providers prefer online portals, 27% prefer phone calls, and 11% prefer in-person meetings.

Specialized Coverage Trusted by Over 500,000 Small Businesses in the US & Canada

Over half a million small healthcare businesses in North America already rely on specialized coverage for security and compliance.

What Does Home Care Insurance Cover for Agencies and Independent Caregivers?

Covers liability, malpractice, employee injuries, data breaches, and property risks.

Trusted by Over 500,000 Canadian Small Business Owners – Industry Benchmark

Canada’s insurance market shows strong trust in caregiver-focused coverage, reflecting its necessity.

FAQ Section

What is the cost of non-medical home care business insurance?

Non-medical home care business insurance typically ranges from $500–$2,000 annually for small providers in Tier One countries. Costs depend on employee count, revenue, and coverage limits. This insurance usually covers liability, property damage, and potential lawsuits related to non-clinical services like companionship, meal prep, and housekeeping. A key takeaway is that while cheaper than medical malpractice insurance, it still offers essential protection. Always request multiple quotes for the best deal.

How much does home health business insurance cost in the US?

In the US, small caregiver businesses pay between $600–$2,500 annually, while larger agencies can pay $5,000–$20,000 depending on services and staff size. Urban areas like New York and California typically see higher rates due to increased legal risks. Factors include number of employees, annual revenue, and state regulations. For agencies billing Medicare/Medicaid, liability insurance is often mandatory.

Are there reviews for the best home health business insurance providers?

Yes—review platforms and associations often publish rankings. In the US, providers like PHLY, CNA, and Hiscox are frequently rated highly. In the UK, Markel and Aviva stand out. Reviews highlight affordability, claims handling, and customer service. Canadian agencies often prefer Intact Insurance, while Australian providers use Allianz and BizCover. Always cross-compare online reviews with independent broker recommendations.

What is the cheapest home health business insurance option for startups?

For startups, bundled packages are usually cheapest. For example, a Business Owner’s Policy (BOP) combines general liability and property coverage at reduced rates. In the US, premiums start at $600 annually. UK startups can find entry-level coverage at £300. Choosing a specialized provider helps cut costs, as they understand caregiver risks better.

What is the best insurance for home health care agencies in Tier One countries?

The best insurance varies by market. In the US, PHLY and CNA specialize in healthcare risks. In the UK, Aviva and Markel offer dedicated home care policies. Canada favors Intact and HUB International, while Australia leans on Allianz and BizCover. The “best” is the provider balancing coverage breadth, compliance, and affordability.

Which is the best home health business insurance company in 2025?

In 2025, PHLY (US), Aviva (UK), Intact (Canada), and Allianz (Australia) are leading providers due to strong claims support and tailored caregiver policies. However, the best choice depends on business size, services offered, and location. Always consult brokers for localized advice.

How much is liability insurance for a home health agency in California?

In California, liability insurance averages $1,500–$5,000 annually for small agencies. Larger operations may pay $10,000+. High litigation rates in California drive costs up compared to other states. Bundling workers’ comp and auto coverage can reduce expenses.

What types of liability insurance do home care businesses need?

Home care businesses need general liability, professional liability, and workers’ comp. Many also add cyber liability due to sensitive patient data. Fidelity bonds may be required to protect against theft claims.

How much is insurance for a small home care business in Canada?

Small caregiver businesses in Canada typically pay CAD $500–$2,200 annually. Agencies with 10+ staff can expect CAD $6,000–$15,000. Costs depend on province, client base, and services. Ontario and British Columbia usually have higher premiums due to population density.

How do small businesses get affordable health insurance for caregivers?

Small businesses can access group health plans through associations, trade groups, or PEOs (Professional Employer Organizations). Bundling business insurance with employee health coverage often lowers costs. Exploring subsidies and tax credits also makes caregiver health insurance more affordable.