Managing employee health insurance is one of the most complex and expensive challenges for businesses in Tier One countries like the United States, United Kingdom, Canada, and Australia. Health insurance premiums continue to rise, compliance rules are constantly shifting, and employees demand more competitive benefits packages to stay engaged and loyal. This is where Professional Employer Organizations (PEOs) step in as game-changers.

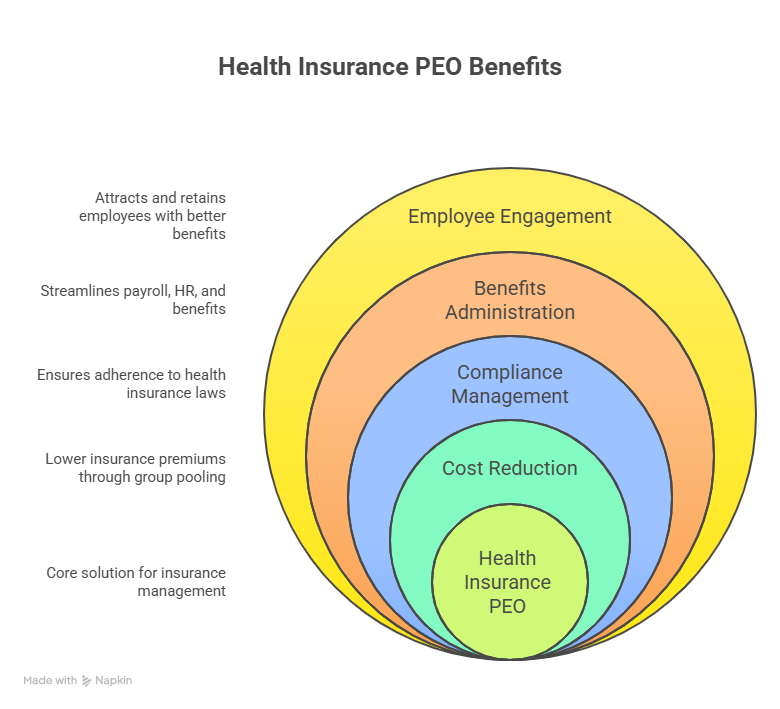

A Health Insurance PEO solution allows small and mid-sized businesses to access enterprise-level insurance plans at reduced costs while outsourcing payroll, HR, compliance, and benefits administration. By pooling employees into larger risk groups, PEOs negotiate better rates with insurers, giving businesses the ability to compete with Fortune 500 companies without breaking the bank.

For US employers, compliance with ACA (Affordable Care Act) and laws like the Pregnant Workers Fairness Act adds another layer of complexity. In the UK and Canada, small group plans often cost more than PEO-based plans. And in Australia, navigating the Fair Work Act and healthcare entitlements can be a headache without expert support.

Key Takeaway: Partnering with the right PEO isn’t just about saving money—it’s about reducing compliance risk, improving employee retention, and creating a scalable HR infrastructure that fuels growth across borders. Explore how PEO health insurance works, when to join or leave a provider, and which PEO is best for your business in Tier One markets.

Benefits of Partnering with a PEO for Health Insurance in Tier One Markets

Businesses in the US, UK, Canada, and Australia face different healthcare systems, but they all share one challenge: balancing affordable coverage with competitive benefits. Partnering with a PEO unlocks key advantages:

- Cost Savings Through Group Rates

- PEOs pool employees across multiple businesses to secure lower health insurance premiums.

- Example: A US startup with 50 employees saw costs drop by 25% compared to direct-market rates.

- Compliance Protection

- US: ACA, COBRA, HIPAA, and state-specific mandates.

- UK: NHS-based compliance plus workplace benefits rules.

- Canada: Provincial health systems plus supplemental insurance compliance.

- Australia: Fair Work Act compliance plus superannuation-linked health benefits.

- Access to Fortune 500 Benefits

- Small companies can offer dental, vision, mental health, and disability coverage that typically only large enterprises afford.

- Administrative Efficiency

- A single provider manages payroll, HR, and insurance administration—reducing overhead.

| Market | Average Premium Without PEO | Average Premium With PEO | Savings Potential |

| US | $8,000–$12,000 per employee/year | $6,000–$9,000 | 20–30% |

| UK | £4,000–£6,000 | £3,000–£4,500 | 15–25% |

| Canada | CAD 5,500–7,500 | CAD 4,000–5,500 | 20–25% |

| Australia | AUD 6,000–8,500 | AUD 4,500–6,000 | 20–30% |

Micro-CTA: → Looking to slash healthcare costs? Explore top PEO partners in Tier One markets for instant group-rate savings.

How to Decide if a PEO Is the Right Choice for Your Business

Choosing a PEO is not a one-size-fits-all decision. Here’s how to evaluate if it’s right for you:

- Business Size: PEOs deliver the best ROI for businesses with 10–500 employees. Very large companies may negotiate direct plans.

- Growth Stage: Startups benefit from instant infrastructure, while scaling companies use PEOs to handle global expansion.

- Compliance Burden: If ACA, HIPAA, or provincial mandates are overwhelming, a PEO reduces liability.

- Employee Expectations: Competitive benefits equal better retention. If your team is demanding more coverage, a PEO gives you leverage.

| Factor | When PEO Works Best | When PEO May Not Be Ideal |

| Company Size | 10–500 employees | 1000+ employees with in-house HR |

| Compliance Needs | Complex, multi-state/global | Low-complexity single location |

| Benefits Needs | Employees demand full coverage | Minimal coverage expectations |

| Cost Goals | Reduce premiums & admin | Already have negotiated enterprise plan |

Key Tip: If you’re losing employees to bigger competitors due to weak benefits, that’s the strongest signal you need a PEO.

Micro-CTA: → Unsure if a PEO is worth it? Run a benefits ROI calculator with your current costs vs. PEO savings.

When Is the Best Time to Leave or Switch Your PEO Provider?

Even if your business is already working with a PEO, there comes a time when switching—or leaving entirely—makes sense.

- Cost-Creep Problem: If fees or premiums rise faster than savings, it’s time to reevaluate.

- Service Gaps: Are HR, payroll, or compliance services falling short? Poor service is a red flag.

- Scaling Out: Once your business crosses 1,000 employees, self-insurance or direct-negotiated plans may outperform PEOs.

- Compliance Changes: New laws may require a provider with stronger compliance expertise.

Case Example:

A Canadian SME (120 employees) initially joined a PEO for savings but later switched providers when its growth into the US demanded stronger ACA compliance support. The switch saved 15% annually.

| Signal | Meaning | Action |

| Rising PEO fees | Cost erosion | Negotiate or switch |

| Weak support | Service failure | Change provider |

| Global expansion | PEO lacks coverage | Upgrade to global PEO |

| Large workforce | Over 1,000 employees | Explore self-funded plans |

Takeaway: The best time to leave is when cost, service, or compliance misaligns with your business goals.

Understanding What PEOs Manage: Payroll, HR, and Health Insurance Administration

A PEO is not just insurance—it’s a complete co-employment model. That means your employees remain legally employed by your company, but HR, payroll, and benefits administration are shared with the PEO.

PEOs typically manage:

- Payroll Processing: Automated tax filing, wage payments, and direct deposits.

- Health Insurance: Access to group medical, dental, and vision.

- Compliance: Federal, state, and international labor law alignment.

- HR Administration: Onboarding, performance tracking, and employee relations.

- Workers’ Compensation: Often bundled with health insurance.

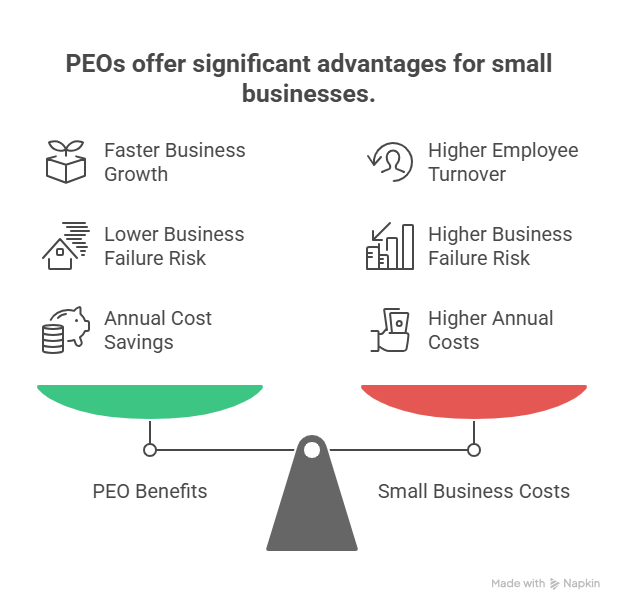

Expert Insight: According to the National Association of Professional Employer Organizations (NAPEO), businesses using PEOs grow 7–9% faster, have 10–14% lower turnover, and are 50% less likely to go out of business.

Micro-CTA: → Want one partner to handle HR, payroll, and insurance? A PEO consolidates it all.

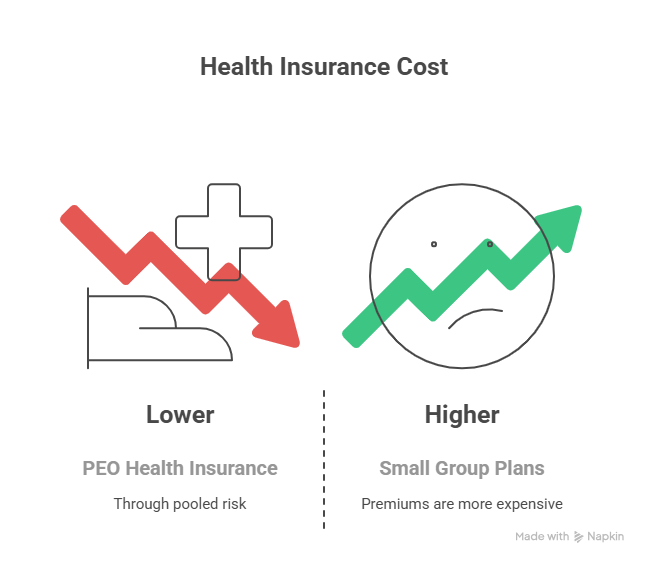

Is Health Insurance More Affordable with a PEO?

Yes—and here’s why: PEOs use economies of scale to negotiate bulk rates with insurers. For small businesses in the US, this can mean saving $2,000–$3,000 per employee annually.

| Market | Average Savings | Primary Driver |

| US | 20–30% | ACA compliance & group risk pooling |

| UK | 15–20% | Access to private health add-ons |

| Canada | 20–25% | Supplementary insurance plans |

| Australia | 15–25% | Fair Work Act alignment |

Pro: Lower premiums, better coverage.

Con: Less flexibility than self-funded large employer plans.

Key Tip: Affordability improves when you have fewer than 500 employees and need Fortune 500-level plans.

How PEOs Improve Employee Retention with Better Health Coverage

Employees don’t just want a paycheck—they want security. Access to high-quality healthcare is the #1 non-wage benefit employees demand in Tier One countries.

- Retention Boost: Companies offering PEO-backed plans reduce turnover by up to 14%.

- Recruitment Edge: PEOs allow small businesses to compete with multinationals in attracting top talent.

- Workforce Morale: Healthier employees = fewer sick days + higher productivity.

| Retention Factor | Without PEO | With PEO |

| Voluntary Turnover | 18–22% | 10–12% |

| Sick Days Avg. | 7.5 per year | 4.2 per year |

| Recruitment Cost | $4,000+ | $2,500–3,000 |

Takeaway: Better coverage isn’t just a perk—it’s an ROI-driving business strategy.

What Is the Pregnant Workers Fairness Act and Why US Employers Must Comply

Effective June 2023, the Pregnant Workers Fairness Act (PWFA) requires US employers with 15+ employees to provide reasonable accommodations to workers affected by pregnancy, childbirth, or related conditions.

A PEO helps ensure compliance by:

- Updating HR policies.

- Training managers on accommodations.

- Avoiding lawsuits by ensuring reasonable workplace adjustments.

Key Tip: If you’re a US employer and not compliant, penalties can be severe. PEOs keep your policies updated automatically.

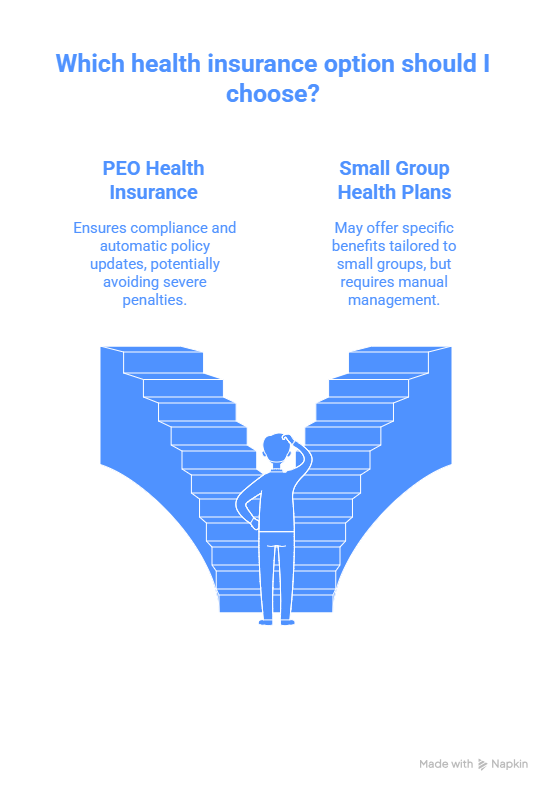

Pros of Small Group Health Plans vs. PEO Health Insurance in the UK & Canada

In the UK and Canada, employers often consider small group health plans. But compared to PEO health insurance, there are clear differences:

| Factor | Small Group Plans | PEO Health Insurance |

| Cost | Higher premiums | Lower through pooled risk |

| Flexibility | Employer negotiates options | Limited by PEO contracts |

| Compliance | Employer responsibility | PEO handles compliance |

| Employee Benefits | Basic coverage | Enhanced, enterprise-level coverage |

Takeaway: PEOs win on cost and compliance, while small group plans offer slightly more flexibility.

Technology-Driven PEO Services for Scalable HR & Insurance Management

Modern PEOs are tech-first platforms. AI, cloud HR systems, and mobile apps streamline benefits and compliance.

- Self-Service Portals: Employees choose plans digitally.

- AI Compliance Alerts: Real-time ACA or GDPR alerts.

- Global Dashboards: Manage cross-border HR and insurance in one view.

Micro-CTA: → Explore PEOs like Deel, ADP, and Rippling that blend technology with compliance for global scalability.

How to Choose the Right PEO for Health Insurance in the US, UK, and Australia

Checklist:

- Verify accreditation (ESAC in the US).

- Compare insurance carriers.

- Assess digital tools.

- Evaluate compliance expertise.

- Read client reviews.

Key Tip: Always request a side-by-side cost-benefit analysis before signing.

Why Businesses Save on Compliance Costs with a PEO Health Insurance Plan

Compliance penalties can bankrupt a business. PEOs prevent:

- ACA fines (up to $2,880 per employee in the US).

- Payroll misclassification penalties.

- GDPR and Fair Work violations.

Result: Businesses cut compliance risk by 50% with PEO partnerships.

What Employers Need to Know About PEOs and ACA Compliance in the US

ACA compliance is a major burden. PEOs ensure:

- Affordable coverage for 95%+ of full-time staff.

- Automated ACA reporting (Forms 1094/1095).

- Avoidance of IRS penalties.

Micro-CTA: → If ACA compliance worries you, a PEO guarantees you won’t face unexpected fines.

How PEO Partnerships Improve Workforce Well-Being and Productivity

Healthier employees = higher productivity. PEO-backed wellness programs include:

- Preventive screenings.

- Mental health support.

- Remote telemedicine.

Key Result: Productivity rises by 8–12% for companies using PEO health plans.

Case Study: How a US Startup Saved 30% on Benefits with a PEO Health Plan

A SaaS startup in California (40 employees) partnered with TriNet. Outcome:

- Reduced benefits costs by 30%.

- Employee satisfaction rose 18%.

- Voluntary turnover dropped to 9%.

Insight: Unlock Continuous Compliance™ with Global PEO Solutions

Continuous Compliance™ is the PEO promise—real-time alignment with changing laws worldwide. From ACA in the US to GDPR in the EU, PEOs auto-update HR policies.

Deel’s Mighty Trio: PEO, Payroll, and Benefits Admin for Tier One Businesses

Deel integrates payroll, benefits, and global PEO services. Businesses in the UK and Australia use it to scale cross-border hiring while staying compliant.

PEO in New York: Payroll, HR & Compliance Guide for US and Global Employers

New York is one of the most compliance-heavy states. A PEO in NY ensures wage laws, insurance, and payroll taxes stay on track—reducing liability.

PEO Evaluation Checklist for Enterprises Expanding in Tier One Countries

- Compare pricing models (per employee vs. % payroll).

- Ask about health plan carriers.

- Confirm local compliance expertise.

- Review tech stack integration.

Employee Benefits Renewal Checklist for Small and Mid-Sized Employers

- Review plan utilization.

- Compare renewal vs. new PEO providers.

- Check employee satisfaction surveys.

- Audit compliance updates.

Expert Insight: PEO vs. EOR — Key Differences That Impact Insurance Costs

- PEO: Co-employment model, cheaper health insurance.

- EOR: Full employer of record, used for global hiring. Costs more but covers countries where you lack legal entities.

Latest Research: Health Insurance Costs for Employers in 2025

- US premiums expected to rise 6.5%.

- UK private health demand up 9%.

- Canada supplemental plans rising 5%.

- Australia: family premiums up AUD 500/year.

How Much Does Offering Health Insurance Through a PEO Really Cost?

On average:

- US: $6,000–$9,000 per employee annually.

- UK: £3,000–£4,500.

- Canada: CAD 4,000–5,500.

- Australia: AUD 4,500–6,000.

Takeaway: Costs are 15–30% lower vs. direct purchase.

FAQ Section

What are PEO health insurance rates in the US, UK, Canada, and Australia?

PEO health insurance rates vary by country and provider but are consistently lower than direct-market small group plans. In the US, rates average $6,000–$9,000 per employee annually, compared to $8,000–$12,000 outside a PEO. In the UK, costs run £3,000–£4,500, while in Canada they average CAD 4,000–5,500. Australia employers pay around AUD 4,500–6,000. Rates depend on company size, risk profile, and benefits selection. Employers save 15–30% by leveraging PEOs.

What are the pros and cons of health insurance through a PEO?

Pros: Lower premiums, compliance support, bundled HR/payroll, and access to enterprise-level benefits. Cons: Less flexibility than custom self-funded plans, co-employment structure may confuse employees, and switching providers can be disruptive. For most SMEs, pros outweigh cons because cost savings and compliance protection deliver immediate ROI.

What are the requirements for health insurance with a PEO?

To qualify, businesses usually need 5–10+ employees. Employers must agree to the co-employment model, where the PEO handles payroll, HR, and benefits. Some PEOs also require minimum participation in health plans (e.g., 70% of eligible staff). In the US, ACA requires coverage for 95%+ of full-time employees, and the PEO ensures compliance.

What is the best health insurance PEO for small and large businesses?

For small businesses, TriNet and Justworks offer affordable group plans. For mid-sized to large businesses, ADP TotalSource and Insperity provide broader HR + compliance tools. Global players like Deel and Rippling excel for international expansion. “Best” depends on your size, industry, and markets served.

Does a PEO provide workers’ compensation insurance along with health benefits?

Yes. Most PEOs bundle workers’ compensation insurance with health benefits. This helps businesses simplify risk management, payroll, and compliance under one provider. By integrating workers’ comp and health, PEOs reduce admin costs and avoid gaps in coverage.

What is a PEO and how does it work?

A PEO (Professional Employer Organization) is a co-employment partner. Your company retains control over day-to-day work, while the PEO manages payroll, benefits, HR, and compliance. Employees are technically employed by both entities, which allows the PEO to secure better health insurance rates through group pooling.

Who are the top PEO companies for health insurance (ADP, TriNet, Insperity)?

- ADP TotalSource: Strong for enterprise payroll + ACA compliance.

- TriNet: Ideal for small to mid-sized businesses seeking affordable coverage.

- Insperity: Known for robust HR consulting.

Other notable names: Deel, Rippling, Paychex PEO.

What PEO health benefits are typically included in Tier One markets?

PEOs offer: medical, dental, vision, disability, mental health, wellness programs, and telemedicine. Many also include retirement plans (401k in US, superannuation in Australia, pensions in UK/Canada).

ADP PEO vs. TriNet PEO: Which is better for health insurance in the US?

- ADP PEO: Best for compliance-heavy industries and larger companies.

- TriNet PEO: Best for cost-sensitive startups and SMEs.

Both provide ACA-compliant group plans but differ in service model.

How does a PEO improve ROI on employee health insurance plans?

ROI comes from lower premiums (15–30% savings), reduced compliance risk, improved retention, and fewer HR staff hours spent on administration. Healthier employees drive higher productivity and lower turnover, which compounds savings over time.