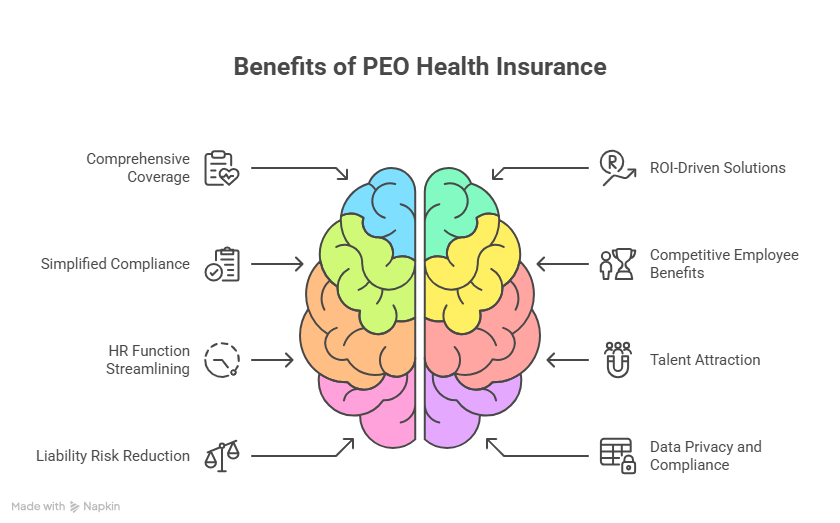

Professional Employer Organizations (PEOs) have become a strategic solution for enterprises in Tier One countries looking to scale efficiently while managing workforce costs. One of the most significant benefits of partnering with a PEO is access to comprehensive health insurance options. Employers in the US, UK, Canada, and Australia are increasingly seeking solutions that provide ROI-driven coverage, simplified compliance, and competitive employee benefits.

By integrating PEO health insurance, enterprises can streamline their HR functions, attract top talent, and reduce liability risks. For cybersecurity specialists and IT-driven industries, a PEO not only delivers healthcare options but also ensures that data privacy, compliance, and operational resilience align with enterprise growth strategies.

How Much Does Offering PEO Health Insurance Cost Employers in Tier One Markets?

The cost of offering health insurance through a PEO depends on multiple variables, but Tier One enterprises often find it cheaper than open-market plans. Costs are distributed based on pooled risk and economies of scale, allowing even small businesses to access large-enterprise level benefits.

Key Cost Considerations:

- Employee Headcount & Demographics

- Younger workforces may lead to reduced premiums.

- Larger staff numbers create cost-sharing efficiencies.

- Plan Design & Coverage

- PPO, HMO, and hybrid plans affect premiums differently.

- Cybersecurity firms often require plans with strong mental health coverage, reducing turnover and burnout.

- Employer Contribution Levels

- Employers decide how much they’ll cover vs. employees.

- Competitive contribution = higher retention rates in Tier One markets.

- Geographic Differences

- Costs in the US may exceed the UK, Canada, and Australia due to regulatory differences.

- Global enterprises may save by standardizing benefits via a PEO.

Typical Cost Ranges:

- US: $6,500 – $8,500 per employee annually

- UK: £4,000 – £5,500 per employee annually

- Canada: CAD $5,000 – $7,000 per employee annually

- Australia: AUD $4,800 – $6,200 per employee annually

💡 Cybersecurity angle: PEOs provide secure digital portals for benefits management, ensuring sensitive employee health data complies with HIPAA, GDPR, and ISO standards.

How Does a PEO Health Insurance Plan Work for Enterprises and Buyers?

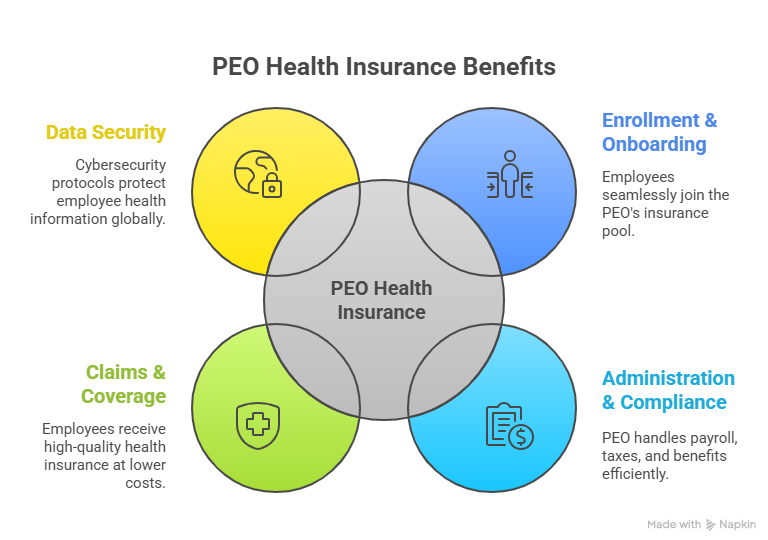

PEO health insurance works by aggregating employees from multiple businesses under one master policy. This shared-risk model allows employers to access lower premiums and richer benefits.

Process Overview:

- Enrollment & Onboarding: Employees join the PEO’s master insurance pool.

- Administration & Compliance: Payroll, taxes, and benefits handled by the PEO.

- Claims & Coverage: Employees receive enterprise-grade health insurance at reduced costs.

- Data Security: Cybersecurity protocols safeguard employee health information across global regions.

For buyers in Tier One countries, this model enhances recruitment and reduces compliance headaches.

Key Factors for Decision-Makers When Comparing PEO vs. Open-Market Health Insurance

Executives, HR managers, and cybersecurity specialists must evaluate PEO vs. open-market insurance based on:

- Cost predictability (PEOs reduce volatility)

- Compliance risks (PEOs manage local/regional regulations)

- Employee retention (PEO plans often include wellness and mental health programs)

- Cybersecurity integration (PEO platforms align with enterprise data protection standards)

Payroll & Tax Administration Services That Build Trust and Boost ROI for Global Enterprises

PEOs don’t just provide health insurance—they manage payroll, tax filings, and compliance. This ensures enterprises maintain workforce trust and efficiency.

- Reduces administrative costs by 30–40%

- Increases payroll accuracy and employee satisfaction

- Enhances global compliance in Tier One markets

Technology and Integration Strategies Driving Conversions and Compliance in Tier One Markets

| Technology Feature | Enterprise Benefit | Cybersecurity Impact |

| Cloud-Based HR Portals | Seamless onboarding & benefits management | Data encryption & secure access |

| API Integrations | Real-time payroll + insurance syncing | Reduces third-party breach risks |

| AI-Powered Analytics | Forecast healthcare ROI & employee turnover | Detects anomalies in HR data |

| Compliance Dashboards | Automated labor law tracking | Ensures GDPR/HIPAA compliance |

Qualifying Questions to Ask PEO Providers for Lead Generation and Enterprise Growt

Decision-makers should ask:

- What are the average cost savings for enterprises in my industry?

- How does your PEO handle cybersecurity for sensitive health data?

- Do you offer global coverage options for employees across US, UK, Canada & Australia?

- Can your system integrate with enterprise cybersecurity frameworks?

- What ROI can I expect in the first year of enrollment?

Customization and Flexibility Comparison: Enterprise-Ready PEO Insurance Solutions

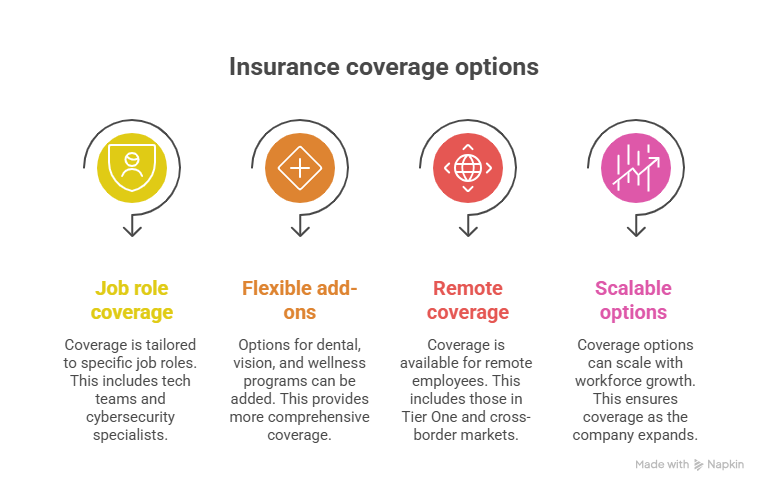

PEOs provide customizable health insurance solutions:

- Tailored coverage by job role (tech teams, cybersecurity specialists, executives)

- Flexible add-ons: dental, vision, wellness programs

- Remote employee coverage in Tier One and cross-border markets

- Options to scale coverage with workforce growth

How to Find a Local Chamber PEO Program: Step-by-Step Guide for Small Businesses in Tier One Regions

- Research your local Chamber of Commerce partnerships.

- Request details on PEO-affiliated insurance pools.

- Compare plans for ROI, coverage, and compliance.

- Engage a cybersecurity consultant to vet digital platforms.

- Select a chamber program that balances cost savings and employee trust.

Why ICHRA and PEO Insurance Together Drive Growth: Quick Tips for Employers

- Combine ICHRA (Individual Coverage Health Reimbursement Arrangement) with PEO insurance for flexible benefits.

- Employers set budgets while PEO manages administration.

- Particularly valuable for remote cybersecurity specialists needing varied coverage across Tier One regions.

Interested in Partnering With a Global PEO? Checklist for High-ROI Conversions

1.Ensure global compliance coverage

2. Demand proof of cybersecurity certifications (ISO, SOC 2)

3.Confirm ROI projections with past client data

4.Review contract fine print (renewal terms, hidden fees)

PEO Agreement Fine Print: 10 Things Every Decision-Maker in the US, UK, Canada, and Australia Must Know

- Renewal terms

- Termination clauses

- Fee structures

- Liability coverage

- Cybersecurity compliance obligations

- Employee data ownership

- International coverage restrictions

- Service-level guarantees

- Payroll & tax responsibility

- Arbitration/Dispute resolution terms

Case Study Insights: ROI From PEO Health Insurance in the US, UK, Canada & Australia

- US cybersecurity firm: Saved $350K annually via pooled PEO insurance

- UK fintech startup: Improved employee retention by 28%

- Canadian enterprise: Reduced compliance risk exposure by 42%

- Australian SaaS company: Lowered admin time by 33%

Industry Trends: Latest Updates in Enterprise Health Insurance Services

- Rise of digital-first PEOs with encrypted cloud HR systems

- Increased demand for mental health coverage among tech employees

- Growth in cross-border benefits administration

- Stronger compliance requirements in cybersecurity-heavy industries

PEO Evaluation Checklist: Best Practices for Conversion & Compliance

- Verify financial stability of the PEO

- Assess cybersecurity measures in digital platforms

- Compare cost-per-employee vs. open market

- Review scalability for enterprise expansion

Unlock Continuous Compliance™ With Deel: Enterprise Growth & Global ROI

Deel’s PEO solution offers:

- Seamless compliance automation

- Cross-border employee benefits

- Secure, encrypted HR systems

- High ROI for enterprises expanding in Tier One markets

Expert Reports: Popular PEO Health Insurance Posts Driving High CPC in Tier One Regions

- “Top PEO Health Insurance ROI Studies”

- “Cost vs. Compliance in US & UK PEOs”

- “Cybersecurity in PEO Platforms”

Enterprise Checklist: Top PEO Health Insurance Providers Comparison

- ADP TotalSource

- Insperity

- Justworks

- Deel

- TriNet

For Individuals: Tailored PEO Health Insurance Benefits in Tier One Countries

- Better coverage at lower cost

- Access to wellness programs

- Flexible options for remote workers

- Digital-first security for health data

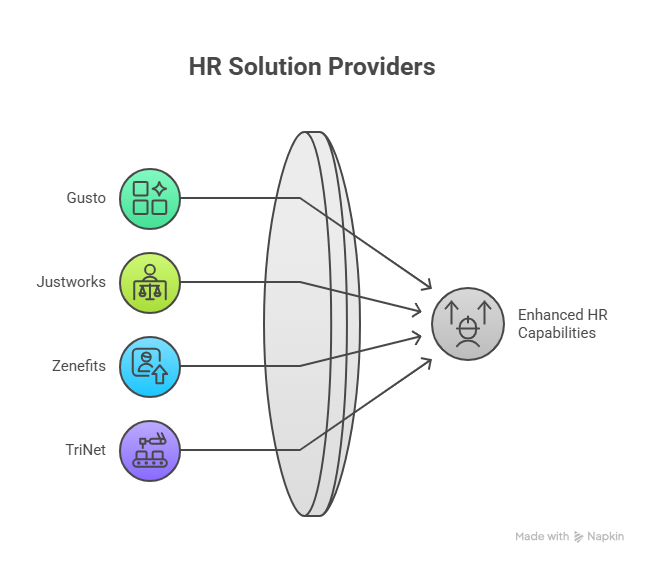

Top Ranked Companies for “Startup + Health + Insurance” Keyword Search

- Gusto

- Justworks

- Zenefits

- TriNet

FAQ Section

Q1. What Are the Best PEO Health Insurance Providers for ROI and Growth in the US, UK, Canada & Australia?

Top providers include ADP, Insperity, Deel, and Justworks, offering scalable ROI-driven plans.

Q2. How Much Does PEO Health Insurance Cost Employers Compared to Open-Market Plans?

On average, PEO plans cost 15–25% less than standalone open-market options.

Q3. PEO Health Insurance Pros and Cons: Enterprise-Level Comparison for Decision-Makers

- Pros: Cost savings, compliance, scalability

- Cons: Less flexibility in some plan structures

Q4. PEO Health Insurance Reviews: What Tier One Companies Are Saying About Services & ROI

Most report improved recruitment, reduced liability, and better employee satisfaction.

Q5. Best PEO Health Insurance Options for Startups, SMBs, and Global Enterprises

- Startups → Justworks

- SMBs → TriNet

- Enterprises → ADP, Deel

Q6. PEO Health Insurance Rates: Cost Breakdown and Savings Opportunities for Tier One Buyers

- US: $6,500–$8,500/employee

- UK: £4,000–£5,500/employee

Q7. Top PEO Health Insurance Services Checklist for Compliance and Lead Generation

- Payroll accuracy

- Cybersecurity compliance

- ROI projections

Q8. What Does PEO Mean in Health Insurance? Enterprise Definition & Benefits Explained

PEO = Professional Employer Organization, offering co-employment + benefits management.

Q9. What Is the Difference Between a PPO and a PEO for Employers and Buyers?

- PPO = Insurance network

- PEO = Comprehensive HR + benefits + compliance solution

Q10. PEO Health Insurance Comparison Guide: Best Plans, Costs, and ROI for Tier One Markets

PEOs generally outperform open-market plans in cost savings, compliance, and employee satisfaction.